NASPP Blog

Search results not displayed for crawlers

Most Recent Posts

-

Private Company Underwater Equity: The Cost of Inaction

Private Company Underwater Equity: The Cost of InactionFeb 19, 2026

Inaction on underwater equity is a strategic choice. Learn the hidden costs of waiting and how it impacts retention, pay strategy, and culture. -

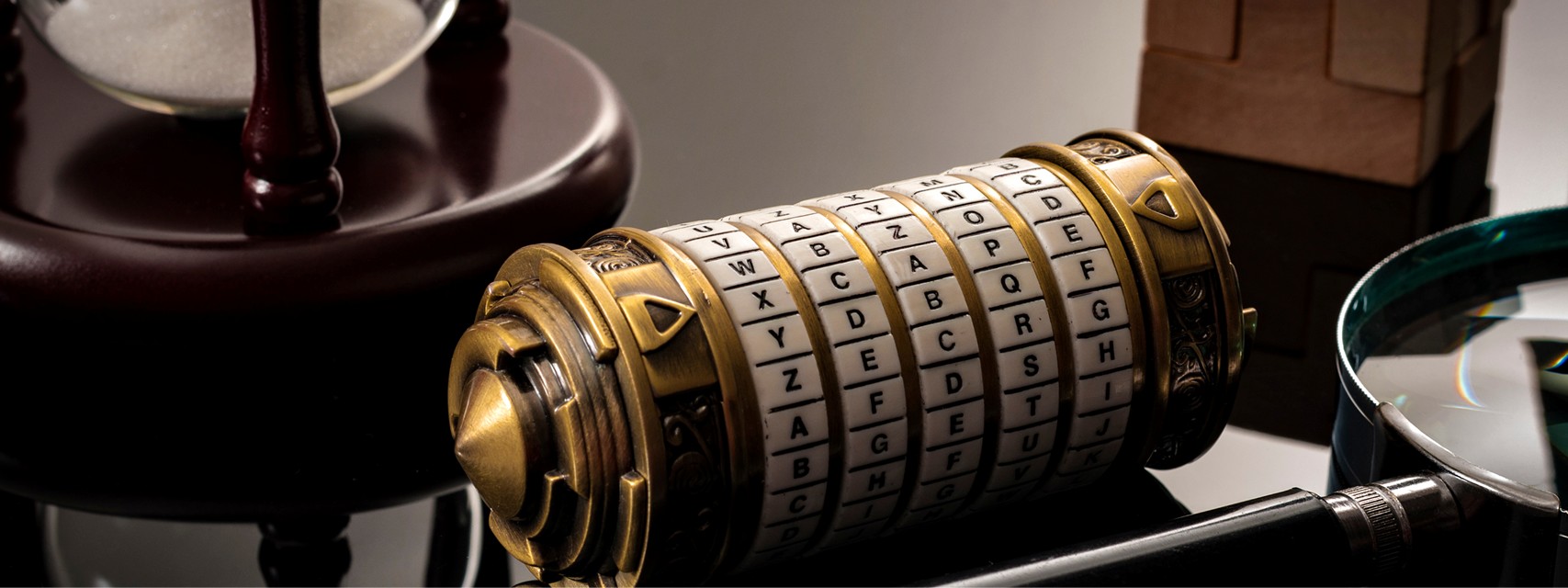

Private Company Equity Terms: Rule 701, 409A & Cap Table

Private Company Equity Terms: Rule 701, 409A & Cap TableFeb 12, 2026

Decode key private company equity terms: Rule 701, 409A valuations, cheap stock, and cap table mechanics for stock plan admins from public companies. -

Section 16 Reporting After Insider Departure

Section 16 Reporting After Insider DepartureFeb 11, 2026

Understand Section 16 reporting obligations after an insider leaves, including Form 4 exit box rules and post-termination transactions. -

Refresher Grants: A Founder’s Guide to Equity Retention

Refresher Grants: A Founder’s Guide to Equity RetentionFeb 5, 2026

Learn how refresher grants work, when to use promotion, performance and tenure refreshers, and how founders manage dilution as companies grow. -

Hiring in Israel: How Section 102 Shapes Equity Compensation

Hiring in Israel: How Section 102 Shapes Equity CompensationFeb 4, 2026

Israel’s Section 102 shapes equity compensation through tax deferral and a 25% capital gains rate. Learn key compliance requirements. -

Back to Basics: Fair Value and Fair Market Value Explained

Back to Basics: Fair Value and Fair Market Value ExplainedJan 29, 2026

Learn the differences between fair value and fair market value and how they affect equity compensation, reporting, and tax compliance. -

Proxy Season Prep: ISS Changes Affecting Equity Plans

Proxy Season Prep: ISS Changes Affecting Equity PlansJan 28, 2026

ISS 2026 updates add a new Equity Plan Scorecard overriding factor and change burn rate benchmarks. What plan sponsors should know. -

Private Company Option Exchanges: A Practical How-To Guide

Private Company Option Exchanges: A Practical How-To GuideJan 22, 2026

A practical guide to executing private company stock option exchanges with precision, controls, and audit-ready administration. -

Myths That Lead to Mobility Tax Mistakes

Myths That Lead to Mobility Tax MistakesJan 21, 2026

Avoid costly mobility tax mistakes by busting common equity compliance myths for mobile employees.

Subscribe to Our E-Newsletter

Get blog updates and other exclusive NASPP content delivered straight to your inbox every two weeks.