Private Company Equity Terms: Rule 701, 409A & Cap Table

February 12, 2026

Decoding Private Company Equity Terms for Plan Administrators

Working as a stock plan administrator (SPA) at a public company requires constant readiness: SEC filings, daily updates, and strict governance and compliance requirements. The work is visible, fast-paced, and regulated at every turn.

Private company equity presents different challenges. At public companies, fair market value is a ticker lookup. Liquidity exists. Rights, preferences, and capital structure mechanics rarely touch your desk.

Private companies operate differently. Valuation requires formal appraisals. Liquidity depends on corporate events years away. And the capital structure, with its layered preferences and conversion mechanics, directly determines whether employee equity holds any value at all.

This guide decodes essential private company terminology, focusing on the regulatory framework, capital structure mechanics, and administrative distinctions that define daily work in the private space.

Tax and Regulatory Framework

Public companies register shares for issuance under Form S-8. Private companies rely on exemptions—and maintaining those exemptions requires continuous oversight.

Rule 701: Your New Registration Exemption

Most private companies issuing equity awards rely on Rule 701, which exempts non-reporting companies from registering shares issued under compensatory plans.

Rule 701 applies when:

- The issuer is not an SEC reporting company

- Securities are issued under a written compensatory plan

- Participants are natural persons acting as employees, directors, consultants, or advisors

- Services provided are bona fide and unrelated to fundraising

Annual issuance limits:

Rule 701 permits issuance up to the greatest of:

- $1 million

- 15% of total assets

- 15% of outstanding securities of the offered share class

Enhanced disclosure requirement: If annual issuance exceeds $10 million in any 12-month period, additional disclosures become mandatory.

A professional recently asked me: "Do I have to track this every time?"

Answer: Yes.

State securities laws (Blue Sky laws) may impose additional requirements. California's Section 25102(o) is the most common landmine that trips up many private company admins.

Fair Market Value: From Ticker to 409A Valuation

At public companies, FMV is the closing price on grant date; straightforward and indisputable. Private company FMV requires a periodic valuation under IRC Section 409A; commonly called a 409A valuation.

“Can you use the latest priced round as your FMV?”

Answer: No.

Investors speculate on future value using whatever methods they prefer. Your 409A valuation must follow specific criteria. A poorly executed valuation could raise several issues you want to avoid, especially cheap stock issues.

Understanding the presumption of reasonableness criteria mitigates that risk:

- Independent Appraisal: An independent appraisal as of a date no more than 12 months before the transaction

- Stock Subject to Formula: A valuation determined by a formula (book value, earnings multiple) used consistently for all non-lapse restriction transactions

- Illiquid Startup Stock: For companies with no material business conducted for 10+ years, performed by a person with significant knowledge and experience, where no change in control is reasonably anticipated within 90 days, or a public offering within 180 days, from the action to which the valuation was applied

Cheap Stock Explained

Cheap stock refers to equity awards granted at exercise prices later deemed below fair market value—typically surfacing when companies approach IPO and the SEC reviews historical grant pricing.

The concern isn't that private company options have low strike prices. It's whether the valuation methodology can defend those prices under scrutiny.

When cheap stock is identified, two problems emerge:

First: ASC 718 requires restating compensation expense for understated value—a catch-up charge that can delay offerings and unsettle investors.

Second: Options granted below FMV trigger Section 409A consequences—immediate taxation plus a 20% penalty for affected employees.

QSBS: Know When to Refer Out

Qualified Small Business Stock under IRC Section 1202 permits shareholders to exclude up to $10 million in capital gains upon sale of qualifying stock.

While administrators should recognize QSBS eligibility questions, the qualification analysis—involving asset tests, holding periods, and corporate structure requirements—belongs with tax counsel.

Your role: Know when the question arises and escalate appropriately.

Capital Structure and Exit Economics

Private companies often need investor funding. To attract investors into illiquid investments, preferential terms are included during fundraising rounds.

At a private company, the role of an SPA goes beyond the stock plan. Understanding stock rights and preferences is vital for maintaining a healthy and diligence-ready cap table.

Capitalization

Pre-Money: The state of the cap table with all rights, preferences and liabilities immediately prior to the financing round.

Post-Money: Includes the investment and equity issued pursuant to that round (including converted rights).

Dilution and Convertibles: Convertible notes and SAFEs include provisions based on pre-money or post-money capitalization. These terms—explicitly stated in executed agreements—dictate whether conversion occurs based on the cap table immediately prior to investment or with the investment.

Original Issue Price (OIP): The price per share paid by investors in a financing round. OIP anchors liquidation preference calculations throughout equity documents.

The Liquidation Waterfall

Imagine a champagne tower being filled. If you pour the champagne at the top until it fills the top glass and pours onto the next level of glasses, which are subsequently filled until they pour onto the next one—this is what happens in an exit event.

In a typical waterfall, the holders of each share class receive their liquidation according to their own terms and seniority. Only after satisfying the preferences from each senior class do the next class participate in remaining proceeds, if any.

This preference stack determines the minimum exit value required for each share to have any value.

| Share Class | Seniority (Preference Order) | Preferential Right | $10M Payout | $25M Payout | $50M Payout |

|---|---|---|---|---|---|

| Preferred C-2 | 1 | $18M | $7.8M | $18M | $18M |

| Preferred C-1 | 1 | $5M | $2.2M | $5M | $5M |

| Preferred B | 2 | $10M | $0 | $2M | $10M |

| Preferred A | 3 | $5M | $0 | $0 | $5M |

| Common Stock | 4 | N/A | $0 | $0 | $12M |

Seniority: Preferred Payment Order

The payment order among preferred series. Charter documents specify this hierarchy.

Liquidation Preference Multiplier

Expressed as "1x," "2x," or higher, the multiplier determines how much preferred stockholders receive before common.

A 1x preference returns the original investment. A 2x preference returns double.

Higher multipliers significantly reduce—or eliminate—common stock value in modest exits.

Participating vs Non-Participating Preferences

The distinction between participating and non-participating preferred determines whether investors "double-dip" in exit proceeds.

| Preference Type | Mechanism | Impact on Common |

|---|---|---|

| Non-Participating | Investor receives preference OR converts to common (whichever is greater) | More favorable to common in large exits |

| Participating | Investor receives preference AND shares pro-rata in remaining proceeds | Reduces common share of proceeds |

| Participation Cap | Limits participating returns to a specified multiple (e.g., 3x) | Moderate protection for common |

Table: Participation structures and their impact on common stockholders

Preferred Conversion Mechanics

In large exits, when common stock payout exceeds the value receivable by a non-participating preferred class, that preferred class automatically converts into common stock and receives payment with all common stockholders.

Conversion Price: The price at which preferred stock converts to common, initially equal to the original issue price. Anti-dilution adjustments in down rounds may reduce this price.

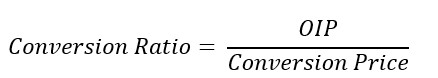

Conversion Ratio: The number of common shares received per preferred share upon conversion.

A reduced conversion price increases the conversion ratio, meaning each preferred share converts into more common shares, diluting existing common holders.

Stock Plan Administration Terminology

Share Disposition: The Private Company Default

Unlike public companies that need to register the issuance of new shares and routinely maintain treasury stock for buyback programs and market activities, private companies overwhelmingly retire shares to authorized but unissued status.

This isn't arbitrary. It reflects structural realities:

- No Active Market Requiring Inventory—Public companies hold treasury shares for stock buybacks, employee plan settlements, and market stabilization. Private companies lack a trading market—there's no operational reason to maintain share inventory.

- State Law Defaults—Most state corporate statutes (Delaware General Corporation Law § 243, for example) provide that repurchased shares automatically return to authorized but unissued status unless the board specifically designates them as treasury. Private companies rarely make that affirmative designation.

- Cap Table Simplicity—Treasury shares create a third category between "authorized but unissued" and "outstanding"—adding complexity without corresponding benefit. Clean cap tables matter in private company financings and exit unnecessary line items invite questions during diligence.

Returning Shares: Plan Language Matters

Your equity plan dictates what happens when awards are forfeited, cancelled, or expire unexercised. Most private company plans include "recycling" provisions returning these shares to the plan pool for future grants.

However, repurchased shares follow different logic. When the company exercises a repurchase right on vested shares from a departing employee, those shares typically:

- Return to the company's authorized but unissued, but

- Do not return to the equity plan pool unless the plan explicitly permits it

In most cases, you'll find private companies operate with a simpler binary: shares are either outstanding or authorized but unissued. Treasury shares, while legally permissible, remain a public company convention that rarely crosses into private company practice.

Dead Equity

Dead equity is ownership sitting in the hands of people who are no longer building the company—ex-founders, departed employees, inactive advisors, or early investors who no longer engage. Ownership is a powerful incentive; that's what being an SPA is all about.

In a fast-growing private company, equity is meant to signal commitment and align incentives; every point on the cap table is scarce currency you use to attract talent, reward execution, and bring in capital. When too much of that currency is locked up with non-contributors, it creates drag: less equity to recruit and retain key people, visible misalignment between ownership and effort, and a cap table profile that many investors treat as a serious liability.

Proactive repurchase programs and secondary sale opportunities address dead equity accumulation.

Conclusion

Private company administration layers capital structure complexity onto equity fundamentals you already understand. Core competencies transfer—grant processing, vesting administration, and tax reporting mechanics.

What changes is the context: valuation requires patience, liquidity requires planning, and employee value depends on waterfall math that rewards deep structural understanding.

Master these terms, and you'll translate private company complexity into clear guidance for employees navigating equity they cannot yet sell—but may one day find transformative.

For more resources for private companies, check out the Private Company Stock Plans section on NASPP.com

-

By Matheus AkauãManaging Director, Corporate Risk Management

Equity Admin Co.