Year-End Tax Updates

October 24, 2025

The end of the year always brings a few tax updates. Here are the changes to be aware of as we head into 2026.

FICA Cost-of-Living Adjustments

As announced by the Social Security Administration, the maximum amount of earnings subject to Social Security tax will increase to $184,500 in 2026 (up from $176,100 in 2025). The Social Security tax withholding rate will remain at 6.2%. With the new wage cap, the maximum withholding for Social Security will be $11,439.00 . [Pretty sure, but it’s never a bad idea to check my math. My ability to do math, even with a calculator, is about the same as Justin Timberlake’s in this scene from Friends with Benefits.)

Medicare tax rates also remain the same and are not subject to a maximum (the threshold at which the additional Medicare tax applies is likewise unchanged—this threshold is not tied to inflation).

How Do This Year’s Adjustments Compare to Prior Years?

This year’s wage base is 4.77% higher than last year’s, which is a slightly larger increase than last year and significant in comparison to past wage base increases. The median increase since 1998 is 3.56% (the average is 3.63%). Thus, this year’s increase is higher than normal, but not anywhere near the highest since 1998 (which was the 8.9% increase in 2023).

Why Is the Wage Base Increase Different Than the Benefit Increase?

The increase in the Social Security wage base is considerably higher (4.77%, as noted above) than the increase in benefits (2.8%). Why the difference?

Well, the two amounts are calculated differently. Social Security benefits are tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The Social Security wage base is tied to the National Average Wage Index. In addition, the wage base calculation uses data from the prior year, not the current year. The 2026 wage base increase is tied to 2024 data on wages. The benefits calculation, however, compares the CPI-W for Q3 of the current year to Q3 of the prior year.

Beware Form W-2 Phishing Scams

The end of the year is a good time for me to remind you to be on the lookout for Form W-2 phishing scams, especially if you work in payroll or HR. Here’s how the scam works: the cybercriminal sends you an email that looks like it is from your CEO or another executive and urgently requests a list of all employees and their Forms W-2. If the scammer manages to procure the list, they will file fraudulent tax returns for the employees to claim any refunds that are due to the employees.

If your company has been victimized by this scam, the IRS has announced special procedures to report this. If you notify the IRS quickly enough, they can take steps to prevent employees from being victimized.

A Few of My Favorite Tax Resources

While we’re on the subject of taxes and heading into year-end tax reporting season, I’d like to mention a few of my favorite resources that are available for NASPP members.

Year-End Tax Reporting Webinar

Our annual webinar on US tax reporting for stock compensation is a handy refresher for this once-a-year task. This year’s webinar is scheduled for December 3.

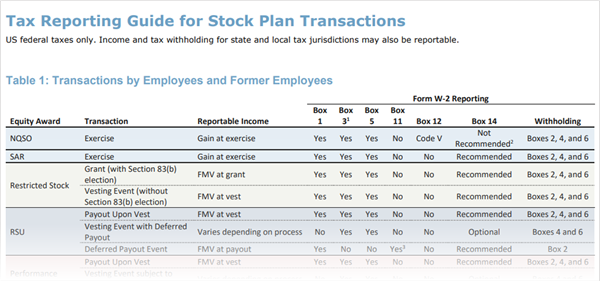

Tax Reporting Guide

Another one of my favorite resources is our handy Tax Reporting Guide for Stock Plan Transactions, which illustrates, in tabular format, how to report an extensive list of stock plan transactions on Form W-2. It provides an easy-to-use checklist to verify that you are reporting stock plan transactions correctly for federal tax purposes.

Form W-2 Reporting Checklist

Make sure you haven’t overlooked any reportable income with our Form W-2 Reporting Checklist. This list can be a helpful framework for your year-end kick-off meeting with payroll.

Tax Reporting FAQs

You’ve got questions on how to report stock plan transactions on Forms W-2, 1099-NEC, and 1099-MISC and we have answers. Check out the following FAQs:

- FAQs on W-2 and 1099 Reporting for Restricted Stock and Units

- FAQs on W-2 and 1099 Reporting for Stock Options

- FAQs on W-2 Reporting for ESPPs

Taxation in the Event of Death, Divorce, and Retirement—Videos Available

Death, divorce, and retirement are some of the trickiest tax withholding and reporting scenarios you can encounter for stock compensation. To help you understand the rules, I recorded three videos that cover the tax treatment of equity awards in these situations. Each video is only about ten minutes long and summarizes the company’s US tax reporting and withholding obligations.

-

By Barbara BaksaExecutive Director

NASPP