Timely Tax Deposits for Stock Plan Transactions

April 05, 2023

We often get questions from members on exactly when tax withholding for stock plan transactions must be deposited with the IRS. Here is a summary of the rules.

Semiweekly Deposit Schedule

The tax withholding for stock compensation is subject to the same deposit requirements as is the withholding collected on salary, wages, and other forms of compensation. These rules are explained in IRS Publication 15, Circular E, Employer’s Tax Guide.

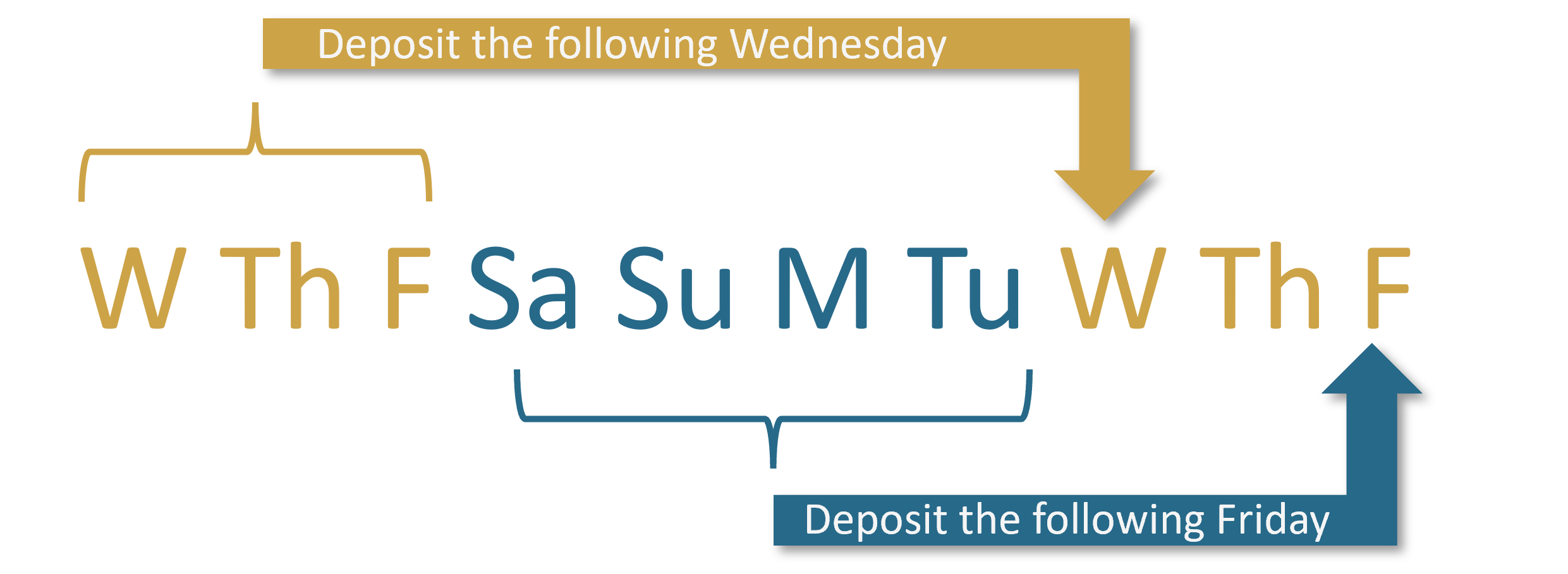

Most companies that offer stock compensation are semi-weekly depositors, meaning they must deposit tax withholding with the IRS two times each week. Deposit accrual periods run from Wednesday to Friday and from Saturday to Tuesday. Taxes must be deposited by the third business day after the last day of the deposit accrual period:

- Tax withholding for payments made on Wednesday, Thursday, or Friday must be deposited by the following Wednesday.

- Tax withholding for payments made on Saturday, Sunday, Monday, or Tuesday must be deposited by the following Friday.

This is the company's normal deposit schedule. If a deposit is due on a day that isn't a business day, the deposit is considered timely if it is made by the close of the next business day.

$100,000 Next-Day Deposit Rule

When a company’s cumulative total tax deposit liability is $100,000 or more, the amounts withheld must be deposited with the IRS by the next business day. For example, if a company’s total tax deposit liability reaches $100,000 on a Tuesday, the IRS would expect that deposit to be made on Wednesday of the same week.

The company’s total tax liability to the IRS includes all taxes that are reported on the company's quarterly tax return on Form 941. It includes income tax and both the employee and employer portions of Social Security and Medicare.

For purposes of this rule, a company’s cumulative deposit liability includes all US employment tax withholding for all employees and all forms of compensation. You aren’t measuring the liability separately for each employee, or each transaction, or even each type of compensation. Thus, it can be fairly easy for any company to reach the $100,000 threshold and trigger this requirement.

One bit of good news is that under this rule, the company’s deposit liability only includes amounts accumulated during the deposit period. For example, if a semiweekly schedule depositor has accumulated a liability of $95,000 on a Tuesday (of a Saturday-through-Tuesday deposit period) and accumulated a $10,000 liability on Wednesday, the $100,000 next-day deposit rule doesn't apply because the $10,000 is accumulated in the next deposit period. Thus, $95,000 must be deposited by Friday and $10,000 must be deposited by the following Wednesday.

Also, once a company’s deposit liability equals $100,000 or more, the company stops accumulating at the end of that day and begins a new accumulation on the next day. For example, say that a semi-weekly depositor accumulates deposit liabilities of $150,000 on Wednesday, $20,000 on Thursday, and $30,000 on Friday. The $150,000 accumulated on Wednesday must be deposited on Thursday, but the $50,000 accumulated on Thursday and Friday doesn’t need to be deposited until the following Wednesday.

Because of the complexity involved in tracking when the $100,000 threshold is reached, many companies always perform a special payroll run to deposit the tax withholding for equity plan transactions, rather than waiting for their regularly scheduled deposit date.

Application to Stock Options

Normally the deposit liability for stock plan transactions accrues on the transaction date, i.e., exercise date for nonqualified stock options. In the case of same-day-sale exercises (the majority of option exercises), however, it is impossible for the company to deposit the tax withholding by the day after the exercise date, since the funds won’t be received from the broker until the settlement date (currently T+2, i.e., the second day after the trade executes but changing to T+1 in May 2024).

As an accommodation, the IRS has instructed its auditors to treat the deposit liability for exercises of nonqualified stock options and stock-settled SARs as accruing on the settlement date, provided settlement occurs no later than the second day after the exercise date.

Application to Restricted Stock Units

IRS auditors are similarly instructed on RSUs: they should treat the company’s deposit liability as accruing on the settlement date, provided that settlement occurs no later than two days after the company initiates the payment of the RSU.

One practice that can help ensure timely tax deposits for RSUs is to define your FMV as the prior day’s close. Almost 20% of respondents to the NASPP/Deloitte Tax 2022 Equity Administration Survey use the prior day close to calculate tax withholding for RSUs, up from 13% in the 2019 survey. This gives you a 24-hour jump on the tax calculations.

Other Types of Equity Awards

The IRS has not provided similar relief for other types of equity awards. Thus, for cash-settled SARs, restricted stock, and other arrangements, companies should treat the deposit liability as accruing on the transaction date. Performance awards that are in the form of units can be treated in the same manner as time-based RSUs.

Penalties

The amount of the penalty for a late deposit correlates with how late the taxes are deposit.

- If the deposit is made within five days of the deadline, the penalty is 2%.

- For periods more than five days to not more than 15 days, the penalty increases to 5%.

- Deposits more than 15 days late are subject to a 10% penalty.

- The amount could potentially increase to 15% if not paid within a certain time frame after the IRS notifies the company of the penalty.

Remember that the late deposit is the entire amount due, not just the amount in excess of $100,000.

Any underpayment of taxes (and the penalties on the underpayment) may also be subject to interest, depending on when the payment is made and other factors.

This is an area of compliance that the IRS audits regularly, so it is important to establish procedures to ensure timely tax deposits.

More Information

To learn more tips for making sure your tax deposits are timely, check out the NASPP webinar “How to Avoid Penalties for the IRS $100,000 Next-Day Deposit Rule.”

And for answers to all your tax withholding and reporting questions, see the NASPP Article, “US Tax Withholding for Stock Compensation.”

-

By Barbara BaksaExecutive Director

NASPP