Statutory Stock Certificates and Modern Equity Management Alternatives

March 08, 2024

If you’re managing equity for a private company you’ve probably found yourself confused at some point by the mechanics of “stock certificates”.

The confusion is warranted: many equity management systems were built as overlays on legacy paper stock certificate systems. Instead of tracking ownership as you would in a digital world, these systems created digital versions of paper certificates.

Thankfully, modern alternatives exist that are endorsed by leading legal jurisdictions and practitioners.

In this article we explore:

What statutory stock certificates are and the historical purposes they served.

The modern alternatives that help companies simplify the management of private company ownership.

Because such a large percentage of startups are formed in Delaware, we limit our discussion to the rules and conventions relevant to private companies incorporated in Delaware.

What are statutory stock certificates?

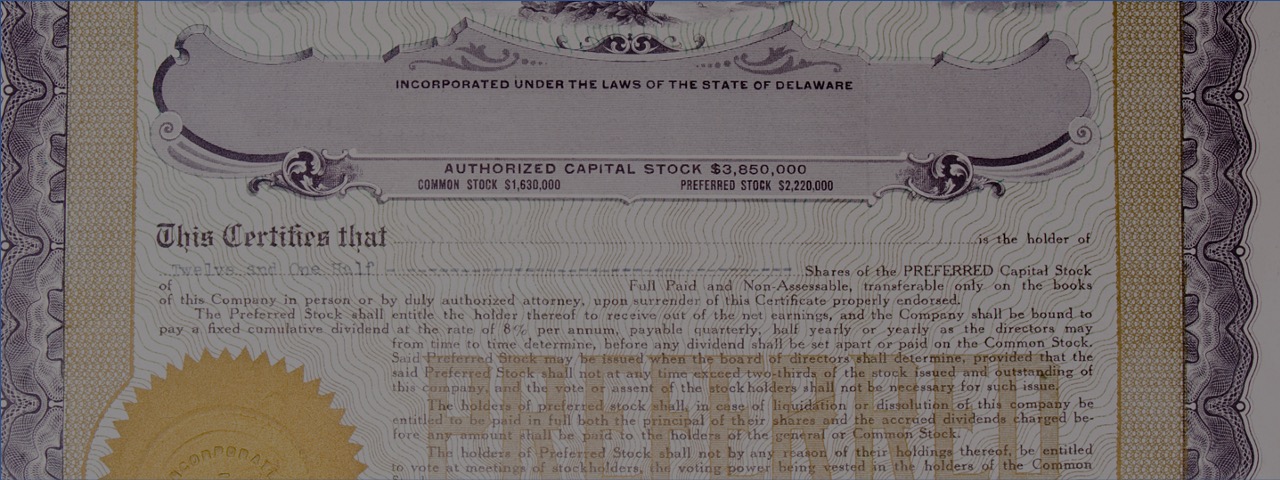

“Statutory” stock certificates refer to stock certificates that comply with Section 158 of the Delaware General Corporations Law.

For the companies that choose to use them, this is the part of Delaware law that governs the issuance of formal stock certificates.

Section 158 provides in relevant part:

The shares of a corporation shall be represented by certificates, provided that the board of directors of the corporation may provide by resolution … that some or all of… its stock shall be uncertificated shares.

….

Every holder of stock represented by certificates shall be entitled to have a certificate signed by, or in the name of, the corporation by any 2 authorized officers of the corporation representing the number of shares registered in certificate form.

The easiest way to understand the purpose of the statutory stock certificates rules is to travel a hundred years back to when both the internet and electronic databases did not exist. (Delaware originally enacted Section 158 in 1899!)

In order to track ownership in this pre-digital age, a company needed a way to both:

1. Keep a centralized record of equity ownership at the company

2. Provide specific records of ownership to equity holders

Because the company couldn’t share an online ownership record, the physical stock certificate provided the shareholder with a record of their ownership. This record of ownership would then be physically updated (canceled or reissued) as that ownership interest changed over time.

The Delaware statutory rules were designed in turn to protect investors and enhance the credibility of this system.

Fortunately, as technologies have evolved to support better methods for tracking ownership, Delaware has updated its rules.

For example:

In 1983 Delaware passed legislation providing an alternative method for Delaware corporations to track shareholders by approving the use of book entry share tracking (also known as “uncertificated”). This is the part of Section 158 that today provides:

the board of directors of the corporation may provide by resolution … that some or all of… its stock shall be uncertificated shares.

In 2005 Delaware went further to make explicit that companies managing shares via book entry are not required to provide statutory stock certificates to the shareholders – even upon request.

As of today, Delaware fully supports both digital statutory certificates and book entry as a form of share management that contemplates the use of digital databases and sharing ownership records online.

Drawbacks and benefits of statutory stock certificates

After considering the historical purposes for statutory stock certificates and Delaware’s support of a modern alternative, it’s natural to wonder why statutory stock certificates are still in use at all.

We now have digital databases and online systems that can easily and reliably communicate digital records of ownership: if you own shares of Google or a Blackrock ETF your brokerage account at Fidelity doesn’t create a digitized replica of an early 20th century stock certificate!

The answer lies mostly in the forces of inertia: it takes time for technological improvements and legislative progress to permeate across the various systems they touch.

That said, there are real costs to

choosing the legacy path of statutory stock certificates.

Here are some of the main costs and benefits to the continued use of statutory stock certificates:

Costs of statutory stock certificates:

1. Administrative time and cost

Delaware companies are not required to use statutory stock certificates. But if they do choose to use statutory certificates, they are required to adhere to certain formalities:

The statutory certificates must be signed by two company officers.

The statutory certificates must include legends referenced in the company’s organizational documents and other agreements.

At best, these requirements add an additional procedural step to each share issuance. At worst, they require a costly process to have corrections made and certificates re-issued.

2. Transaction delays

When a company chooses statutory stock certificates, their presence often creates additional time and cost for the company and stockholders in key exit and merger transactions.

Banks, brokers and paying agents often want to review all statutory stock certificates in connection with a company exit or secondary sale. They sometimes even require digital certificates to be printed and delivered physically.

This administrative process adds time and transaction risk to the closing of critical company transactions that can often be avoided if shares are managed via book entry.

3. Additional complexity

The systems for managing statutory stock certificates – such as their use of “balance certificates” – are often complex and counterintuitive.

Systems for statutory certificates also often record changes in stock ownership differently from how they do so for changes in other equity ownership – creating an additional layer of complexity for users.

Benefits of Statutory Stock Certificates

- Legacy system compatibility:Like any legacy technology, a primary benefit of using paper or digital stock certificates is their compatibility with other legacy systems. Certain types of owners – especially

those with systems created before the digital era – have internal processes that contemplate statutory certificates.

- Historical familiarity:

Certain shareholders also have a preference for the historical format of statutory certificates – irrespective of the practical costs associated with them. The driving reason here is familiarity. Some shareholders are used to seeing statutory certificates and are comfortable with them in the same way some people still prefer the tangible format of cash over digital payments.

As described further below, there are a number of readily available tools that can be used to accommodate these shareholders without the use of formal statutory certificates

Book entry as modern alternative to statutory stock certificates

Companies incorporated in Delaware have an easy and accessible alternative to the costs associated with statutory stock certificates.

If a Company elects to use book entry, it can track ownership without the administrative overhead of statutory certificates.

To enable this, Delaware simply requires that the Company’s board of directors approve the use of book entry as its share tracking system. Many companies will actually already have done this as part of their company formation: tracking corporate ownership via book entry is broadly supported by all major law firms and many enable it by default.

This should come as no surprise given its numerous practical advantages vis-a-vis statutory certificates:

It can reduce the time and cost of issuing and administering equity.

It can reduce the time and cost of key company transactions such as financings and stock sales where statutory stock certificates need to be reviewed.

It reduces complexity for the company and stakeholders by creating a more intuitive and uniform process for reporting ownership across the types of modern equity ownership (eg. shares, options, and convertible instruments like SAFEs).

Leveraging technology in connection with book entry

Several tools help make it relatively simple to move equity management systems forward while accommodating legacy systems.

Document-first Equity Management

A primary purpose statutory certificates served was as evidence of ownership.

An alternative way to provide evidence of ownership is to provide the legal agreements that define ownership rights – stock purchase agreements, amendments, stock splits and the like.

Modern equity management software supports online sharing of these agreements efficiently and securely together with stakeholder ownership data.

Audit Confirmation Letters

Investor inquiries about stock certificates are often related to their audit process. Specifically, an investor’s auditors often send audit confirmation letters to verify an investor’s ownership.

Modern equity management software can help companies streamline the execution of audit confirmation letters by programmatically delivering the required data and documentation to auditors.

Ownership Certificates

Equity management software can provide a more efficient analogue to statutory stock certificates for the purpose of providing ownership certificates for cases where investors require them.

These ownership certificates can satisfy the internal process requirement for many legacy systems without the costs of introducing statutory stock certificates on a company-wide basis.

These non-statutory ownership certificates are already used for the myriad of ownership interests that don’t have statutory stock certificates – for example ownership interests in fund LPs and LLCs.

Modern equity management solutions can automatically generate ownership certificates to meet this need – both for stock as well as other types of ownership interests.

Conclusion

Delaware’s regulatory reforms and technological innovation have created the opportunity for a more efficient and intuitive form of tracking share ownership.

Delaware companies that want to leverage modern technologies and streamline their equity administration should consider implementing book entry as a modern alternative to statutory stock certificates.

-

By Quinn RotchfordFounder Products

AngelList