Moving the Needle on Broad-based Equity

April 24, 2024

Earlier this month I traveled to DC to participate in the Employee Ownership Ideas Forum, sponsored by the Aspen Institute and Rutgers Institute for the Study of Employee Ownership and Profit Sharing. The purpose of the forum was to bring together leading policymakers, practitioners, experts, and the media to discuss how we can grow employee ownership for the shared benefit of American workers and businesses.

Much of the forum focused on ESOPs and cooperatives, but I was invited to talk about equity compensation as a form of employee ownership in public companies.

The Proposal: Encouraging Companies to Grant Equity More Broadly

Before I get to the data I presented, I want to discuss an intriguing idea that was presented at the forum. One of my co-panelists, Robert Patricelli of InTandem Capital Partners, discussed legislation being drafted to encourage public or private companies with more than 500 employees to offer equity broadly.

Introducing SHARE Plans

The bill would create a new type of equity arrangement called a “SHARE plan” (SHARE stands for “Share Holder Allocation for Rewards to Employees”). There are two ways that an equity plan could qualify as a share plan:

- Grant equity equaling at least 5% of the company’s total outstanding common stock to participating employees. This could be accomplished through grants made over multiple years.

- Distribute stock equaling at least 1% of the company’s outstanding common stock to participating employees during a taxable year.

In both cases, the lowest compensated 80% of the company’s US employees would have to participate in the plan and employees earning more than $250,000 per year in cash compensation would have to be excluded. All participating employees would have to receive an equal amount of stock, and the stock could be subject to vesting restrictions of up to five years.

Benefits to the Granting Corporation

Companies that offer SHARE plans would receive a three percentage point reduction in their corporate tax rate. In addition, distributions under the plan would not affect the company’s earnings or profits. That sounds like a pretty good deal.

Benefits to Participating Employees

The arrangement also sounds like a pretty good deal for employees. For starters, employees would receive stock for free (another requirement is that the company cannot make employees pay for the stock issued under the plan). In addition, employees would receive the following tax benefits:

- Distributions of stock under the plan would be excluded from employees’ gross income. (Thus, no required income tax withholding, but I’m not sure about FICA.)

- Capital gains recognized upon sale of the stock could be reduced for expenses for student loans, medical care, and loans secured by a principal residence (which I presume includes the mortgage on that home).

Poll: What Do You Think?

I’m curious to know what you think of the SHARE plans proposal. Complete my short poll to let me know (if you don't see the poll below, clear here to access it).

The Data: Broad-based Equity in Today's Public Companies

The NASPP has been conducting surveys on how public companies use equity to compensate employees since our organization was founded in 1993. These surveys, which we currently cosponsor with Deloitte Tax, give us insight into equity plans at public companies that can’t be gleaned from public filings. During the panel that I participated in, I presented data on how public companies use equity now and how this usage has changed over the past 20 years.

Much of the data I presented is highlighted in the NASPP Advisor article “Five Trends in the Usage of Equity Awards.”

Participate in This Year's Survey

Want access to the latest data on equity compensation at public companies? We’ve extended the deadline to participate in this year’s Equity Incentive Design Survey. Register to participate today.

Equity Grants Below the Senior Executive Rank

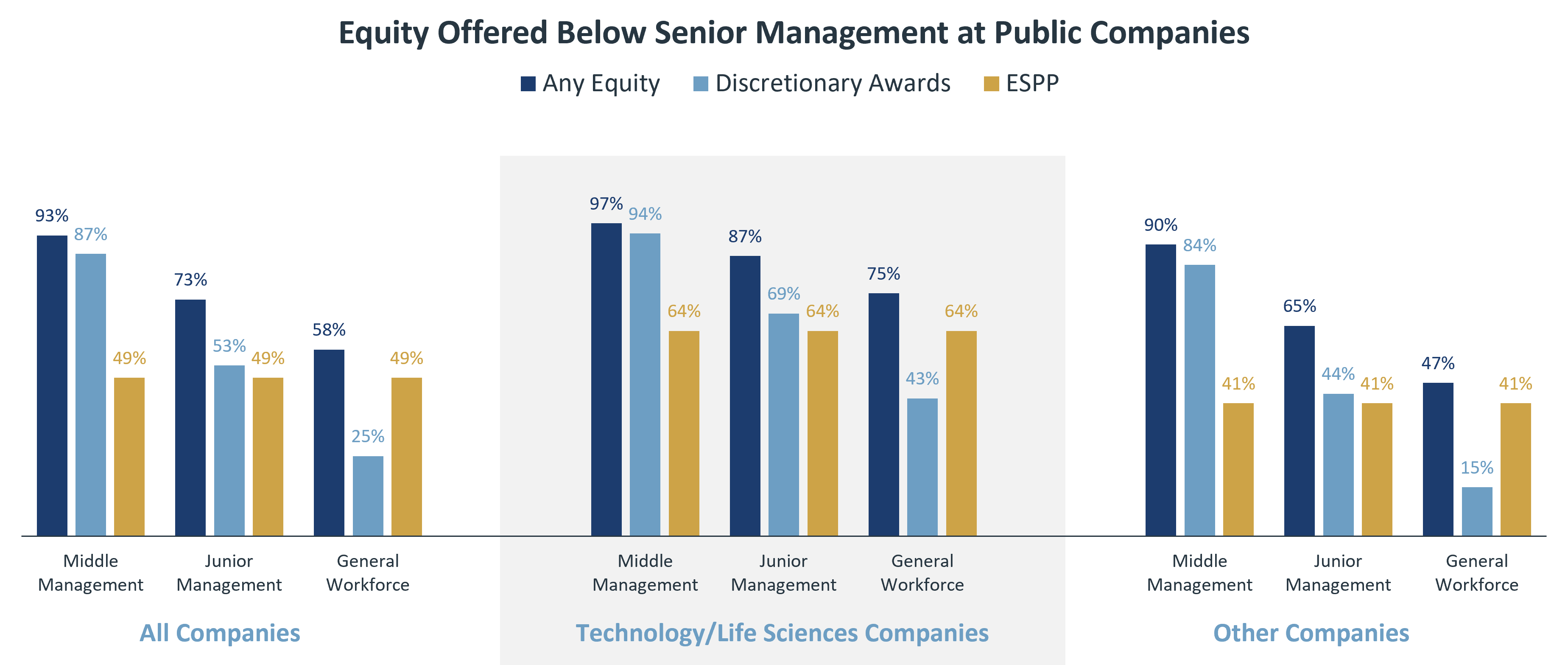

Although public company use of equity below the senior management level has declined in the past 20 years, it is still quite common, especially among technology and life sciences companies. Here are the stats from our most recent Equity Incentives Design Survey (conducted in 2021):

- Middle Management: Over 90% of public companies offer equity to the middle management rank. In the technology and life sciences sectors, nearly 100% of companies grant equity to middle managers.

- Junior Management: Over 70% of public companies offer equity to junior managers. In the technology and life sciences sectors, this percentage climbs to nearly 90%.

- General Workforce: Nearly 60% of public companies offer equity to their general workforce (i.e., nonexempt/hourly workers). Three-fourths of companies in the technology and life sciences sectors offer equity to their general workforce.

Types of Equity Offered

The stats I describe above include equity offered in the form of discretionary awards (stock options and full value awards) and employee stock purchase plans.

At the general workforce rank, equity is typically in the form of an employee stock purchase plan (about 50% of public companies). Only 25% of public companies grant discretionary equity awards (stock options or full value awards) at this rank (just over 40% of technology and life sciences companies and only 15% of other companies).

For junior managers, about half of public companies offer discretionary equity awards and half offer an ESPP. To be clear, this isn’t an either/or proposition: some companies offer both.

For middle managers, equity is more often offered in the form of discretionary awards (87% of all public companies and 94% of technology/life sciences companies).

The chart below illustrates the types of equity vehicles offered by public companies to employees below the senior management rank.

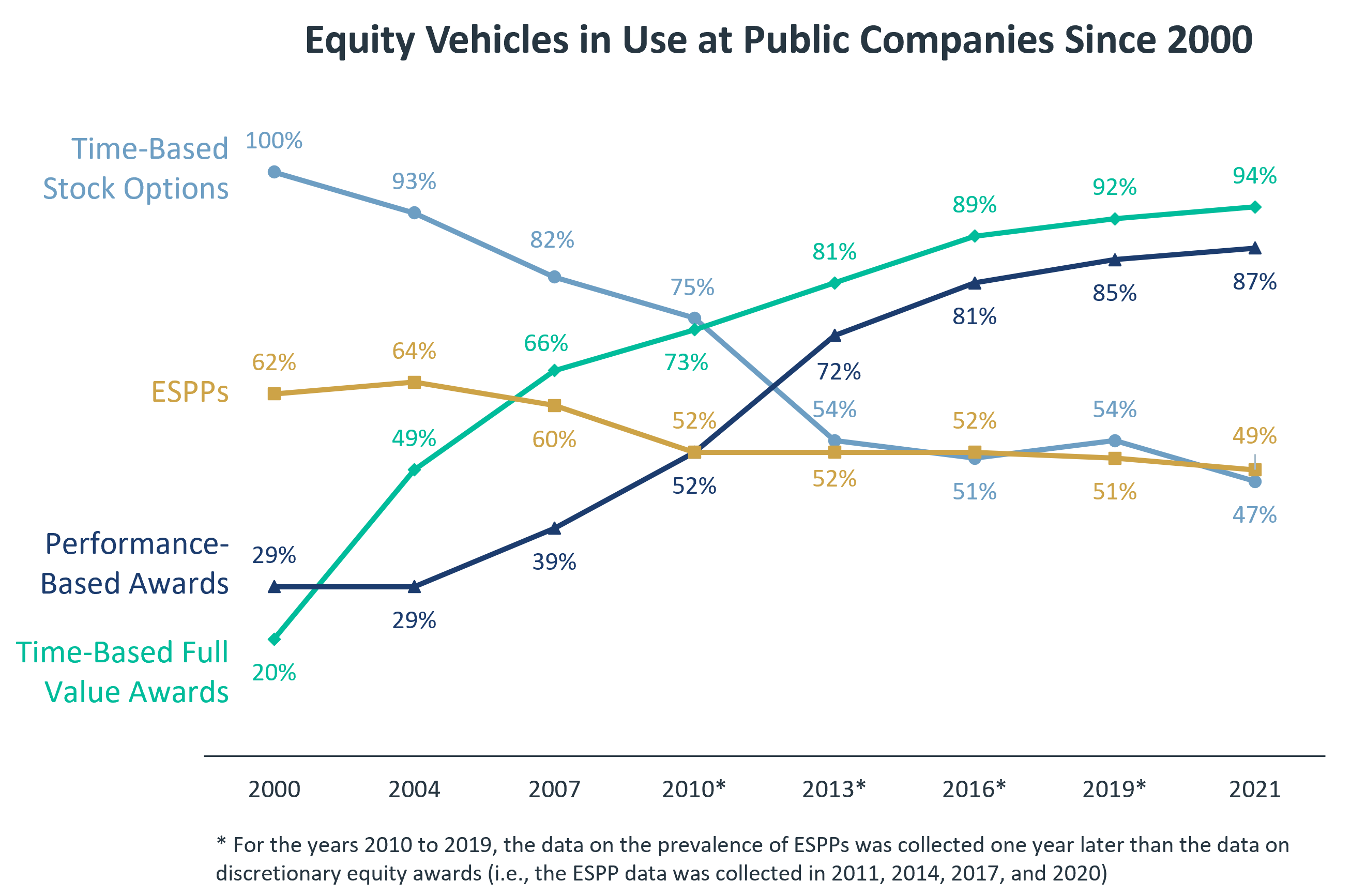

Trends Over the Past 20 Years

Out of context, those data points seem encouraging. But, when we compare practices today to practices two decades ago, we see a marked decline in equity offered to lower ranking employees of public companies. Here’s how things looked twenty years ago:

- Virtually 100% of public companies granted stock options and only 20% granted full value awards (mostly in the form of restricted stock). Today that trend has largely reversed, with less than half of public companies granting stock options and almost all granting full value awards (mostly in the form of RSUs).

- Over 40% of public companies granted stock options to all of their US employees. Fully 74% of technology/life sciences companies granted stock options to all US employees. As noted above, currently, only 25% of public companies (and only 43% of technology/life sciences companies) offer discretionary awards to their general workforce. Moreover, these companies may offer equity to only a portion of employees at this level; they aren’t necessarily granting equity to all employees.

- Over 60% of public companies offered an ESPP, compared to only 50% of public companies now.

The chart below shows how the equity vehicles offered by public companies has changed over the past 20 years.

-

By Barbara BaksaExecutive Director

NASPP