Is Your ESPP Equal or Equitable?

April 07, 2021

ESPPs that are qualified under Section 423 (the majority of ESPPs offered in the United States [1]) must allow substantially all employees to participate on an equal basis. But does this really result in treatment of all employees that is fair and equitable? In many cases, it does not.

Equal vs. Equitable

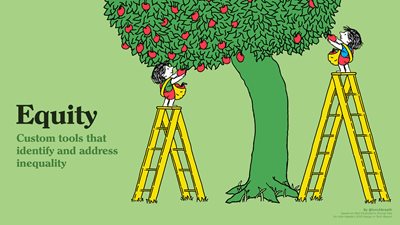

When everyone is treated equally, they all get the exact same thing. This is the right thing to do in some circumstances. But when providing assistance to people with differing levels of need, giving everyone the same thing leaves them in very unequal economic positions. Providing assistance that is specific to each person’s economic situation can produce a more equitable result.

Let’s take a close look at how these concepts relate to ESPPs, with illustrations [2].

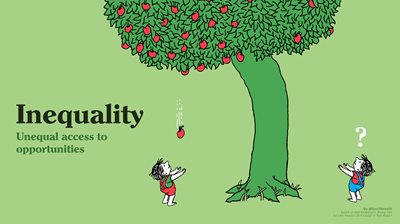

Inequality

This picture illustrates the concept of inequality. The boy on the left gets more apples because he just happens to be standing in the right place.

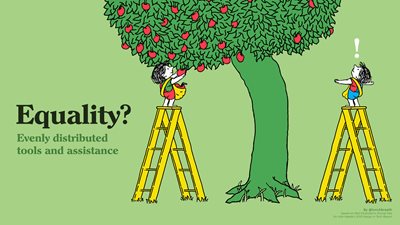

Equality

In this picture, both boys are given a ladder to help them access the apples. Both ladders are perfectly equal. This helps the boy on the left immensely, but the boy on the right still isn’t able to reach the apples. In fact, now that the boy on the left no longer needs to wait for the apples to fall, this well-intentioned strategy has increased the “apple gap” between the two boys.

One reason why so many of us are fans of ESPPs is that they treat everyone equally: under Section 423, substantially all employees must be permitted to participate, and all participants must receive equal rights and privileges. One group of employees can’t receive more favorable rights than any other employees.

All other types of equity awards are discretionary and are more commonly granted to higher paid employees; where public companies offer equity to hourly workers, this is most often done through an ESPP [3]. Even when companies extend discretionary equity awards to lower ranking employees, these employees typically receive much smaller awards than higher paid employees. Qualified ESPPs are unique among equity awards in that they treat everyone equally.

You can see from the illustration however, that treating everyone equally doesn’t mean that everyone is treated equitably. Both boys have the same size ladder, but the boy on the right still can’t reach the apples.

The equal treatment required under Section 423 similarly results in inequity. The predominant means by which employees participate in ESPPs is through payroll contributions. Under Section 423, a plan is considered to satisfy the equal rights and privileges

requirement if all employees are allowed to contribute the same percentage of uniformly defined compensation. This can put lower paid employees at a significant disadvantage. Let’s look at an example:

| Hourly Employee | Salaried Executive | |

|---|---|---|

| Regular Wages | $40,000 | $500,000 |

| Overtime/Shift Premium | $10,000 | $0 |

| Personal Savings | Less than one month's wages | Several months of wages |

Right off the bat, it’s clear that the executive is going to be able to contribute more and buy more stock in the ESPP. The maximum that the hourly employee can contribute is only 1% of the executive’s regular wages. And this assumes that overtime and shift premiums can be contributed to the plan, which often isn’t the case. Around half of companies don’t allow employees to contribute overtime pay and close to two-thirds don’t allow contributions of shift premiums. Lower paid workers have less compensation to contribute to the plan and, oftentimes, a significant portion of their pay isn’t eligible.

Employees typically have a host of amounts deducted from their pay: tax withholding, insurance premiums, retirement plan contributions, HSA/FSA contributions, etc. Some of these contributions are fixed amounts and most are capped, thus these deductions are likely to eat further into the wages of lower paid employees than the wages of those that are higher paid. This leaves lower paid employees with less net wages to cover day-to-day living expenses, pay down debt, build savings, or contribute to the ESPP.

The Washington Post reports that: “According to Nielsen data, the American Payroll Association, CareerBuilder and the National Endowment for Financial Education, somewhere between 50 percent and 78 percent of employees earn just enough money to pay their bills each month.” In addition, Bankrate reports that nearly three in ten adults have no emergency savings whatsoever and one in four have less than three months’ worth of living expenses saved.

All of which is to say that participating in an ESPP may be a stretch for many lower paid employees, who are often disproportionately women and people of color. With very little saved for a rainy day, the hourly employee in my example may simply not have the luxury of contributing to the ESPP at the level he/she would like or participating at all.

Equity

So how do you get to a more equitable ESPP? I have some thoughts on this, which I will share in next week’s blog entry. Check out my video on this topic as well!

[1] According to the NASPP/Deloitte Tax 2023 ESPP Survey, among US companies that offer an ESPP, 84% offer a Section 423-qualified plan.

[2] Illustrations courtesy of Tony Ruth, as featured in the 2019 Design in Tech Report A Google search reveals numerous illustrations that explain the above concepts but I like these because: 1) Shel Silverstein was one of my favorite authors when I was a kid—his books, including The Giving Tree, still sit on my bookshelf; and 2) Mr. Ruth was generous enough to make the illustrations available for anyone to use as they see fit.

[3] Just under half of respondents (49%) to the NASPP/Deloitte 2021 Equity Incentives Design Survey offer an ESPP, which is typically available to all employees including hourly workers. Only 23% of respondents to the survey grant restricted stock/units to hourly workers, only 4% grant stock options to hourly workers, and only 2% grant performance awards at this employee level.

-

By Barbara BaksaExecutive Director

NASPP