New Data on the Gender Pay Gap and Stock Compensation

February 02, 2022

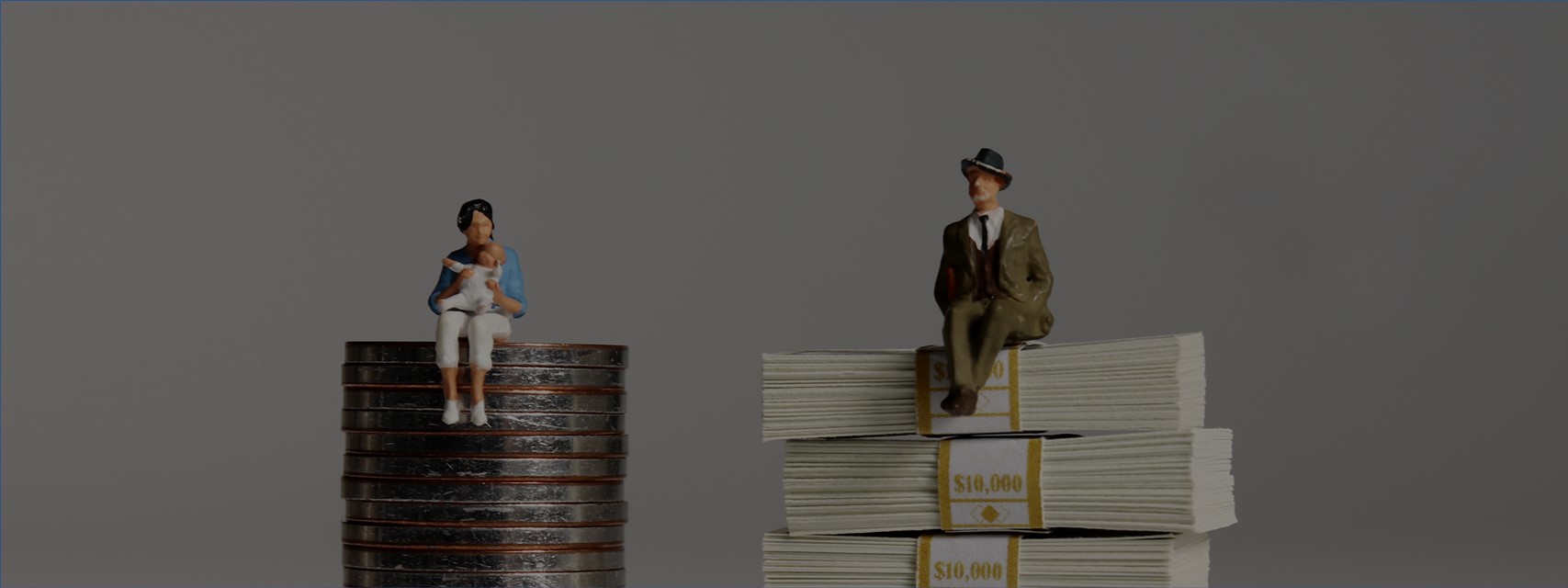

Two recent studies highlight stark differences in equity compensation awarded to men versus women.

Average Company Stock Holdings of Men Almost Four Times That of Women

An analysis conducted for The Wall Street Journal by researchers at the Rutgers Institute for the Study of Employee Ownership and Profit Sharing found that only 17% of female employees hold company stock or stock options, compared with 24% of male employees (“There’s Another Gender Pay Gap: Stock Options”).

Even more alarming, the study found that:

The average value of company shares held by male employees in 2018 was $104,902. For women, it was $26,361.

And, to pile on, since 2002, the average value of employer stock held by men has increased by nearly $30,000 but has fallen by almost $20,000 for women. Those numbers are surprising in and of themselves. But when you consider the potential for future growth in wealth that stock represents, the implications for women are significant.

Women Receive 15% to 30% Fewer Grants

A study published in the Journal of Applied Psychology (“Gender Equity Gap: A Multistudy Investigation of Within-Job Inequality in Equity-Based Awards”) examined two unnamed companies (a tech startup and a large publicly traded company) and found that women received 15% to 30% fewer equity grants than men. When the researchers considered traditionally gender-based nuances in skill sets and occupations, the gap still existed.

Why the Gap?

The WSJ authors attribute this marked difference in the treatment of men vs. women to pay negotiations on the part of men.

In the Journal’s Your Money Briefing podcast, personal finance reporter Julia Carpenter notes that as employees move up the corporate ladder, pay becomes more discretionary. Carpenter and other experts believe that women may not know that they can or should negotiate for more and larger stock awards and that they may justifiably fear a backlash if they do try to negotiate for more equity.

The Role of Manager Discretion

We know that managers often have discretion over equity awards offered to their direct reports. According to our June 2021 Grant Policies pulse survey, which is part of the Equity Compensation Outlook, a collaboration between the NASPP and Fidelity Investments, 80% of companies allow managers discretion over at least one type of award.

Managers are most likely to have discretion over annual grants and/or retention awards, but it is also common for them to have discretion over new hire and/or promotion grants. In many cases managers have discretion over both grant recipients and sizes.

Thus, the disparities identified in the studies may be attributable to the squeaky-wheel syndrome. They could also be attributable to unconscious bias on the part of managers. Experts quoted by the WSJ point out that research shows that women are more likely than their male counterparts to be viewed negatively if they ask for more compensation.

Don’t Let Your Equity Program Reward Negotiation Skills

Rewarding negotiation skills simply isn’t an objective of your equity plan, so it is important to have strong controls that guide grant decisions. Experts quoted in the WSJ article recommend developing transparent guidelines that govern equity award recipients and sizes.

We know from past NASPP/Deloitte Consulting Stock Plan Design surveys that the overwhelming majority of public companies have grant guidelines in place, so a lack of grant guidelines (at least at public companies), isn’t the problem. For some companies, transparency may be a challenge.

I suggest the following processes to help ensure that your equity awards are fair:

- Employees should know whether they are eligible to receive equity grants, the size of grant they can receive, and how decisions as to who receives equity are made.

- Any discretion managers have over grant sizes should be limited and managers should receive training on the factors that should drive their grant recommendations.

- All manager recommendations for equity grants should be reviewed by HR, even those decisions that are within established limits.

- Manager recommendations with respect to equity awards should be compared to recipient performance evaluations to identify misalignments.

- Year-over-year grant recommendations should be reviewed to identify any patterns that might suggest biases.

Finally, companies should also regularly assess the fairness of total compensation, including equity awards. Don’t forget that imbalances in base pay often flow through to other compensation. Employees who receive lower salaries also typically receive smaller bonuses and, where equity awards are expressed as a percentage of pay, receive smaller equity awards. Likewise, employees who are paid less can’t contribute as much to the company ESPP or retirement plans as their higher paid colleagues.

-

By Barbara BaksaExecutive Director

NASPP