Disqualifying vs Qualifying: ISOs

April 03, 2024

Tax qualified awards such as ISOs and qualified section 423 ESPPs, are those that offer the opportunity for employees to gain the most favorable possible outcome as it relates to the taxation of their awards. However, in order to obtain these benefits, there are rules that must be followed.

In this article we’ll be discussing at a high level, what a qualifying and disqualifying disposition is, as well as the tax implications of both types as it relates to incentive stock options.

Preferential Tax Treatment

Incentive Stock Options

ISOs are awards that can only be granted to employees and have quite a few requirements that must be understood from the company side to even qualify for preferential tax treatment.

Some of those requirements are as follows:

- Shareholder Approval

- Employee Only

- Exercise Price Limitations

- Contractual Term Limitations

- 100k Limit

- Etc.

In this article we will be discussing only the impact of disqualifying and qualifying dispositions, but linked below are additional resources that can be used to thoroughly understand this form of equity compensation.

NASPP | Guide to Incentive Stock Options

NASPP | Protecting Employees From the Alternative Minimum Tax Trap

NASPP | Stock Plan Fundamentals

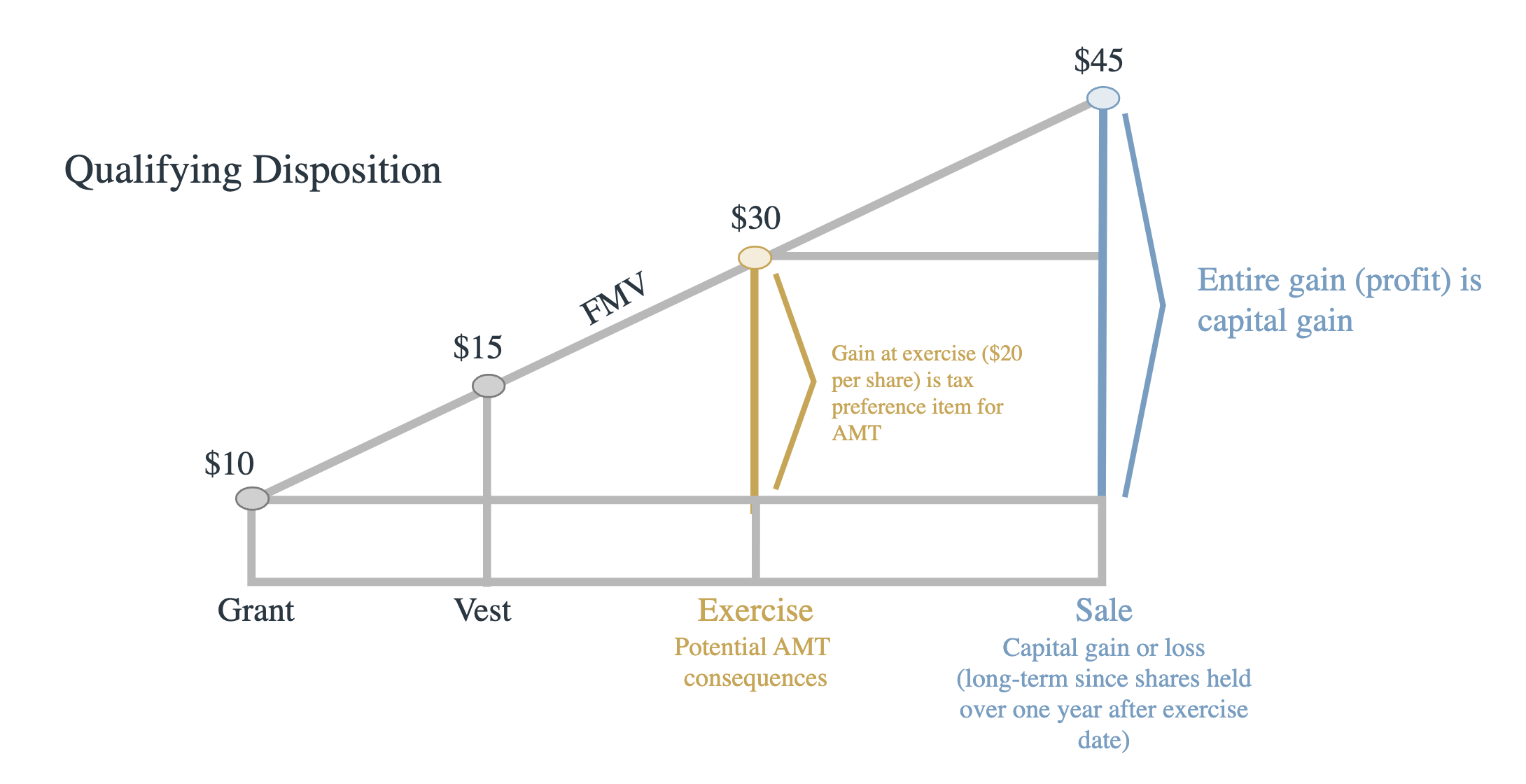

Qualifying Disposition

A qualifying disposition is one where the employee holds their shares for more than two years after the date of grant and one year after the date of exercise (please note that the holding period for the property you acquire when you exercise an option begins on the day after you exercise the option). If both requirements are met in relation to the disposition of shares acquired from the exercise of an incentive stock option, then the holder qualifies for what we call “preferential tax treatment”.

- Grant Date: June 1st, 2021

- Exercise Price: $10

- Shares: 4000

- Date of Exercise: June 1st, 2022

- FMV at Exercise: $30

- Shares Exercised: 1000

- Date of Disposition: June 2nd, 2023

- FMV at Sale: $45

- Shares Sold: 1000

Long Term Capital Gains = $35,000

- $45 (FMV at date of sale) - $10 (FMV at date of grant) = $35 (Spread)

- Shares = 1000

- Tax Rate = Max of 20%

Company Obligations: Reporting

“But what does this mean for the company and their reporting obligations?”

Well, because this was a qualifying disposition nothing would be reported on Form W-2 due to there not being compensation income recorded from the qualifying disposition.

The only reporting requirement would be that of section 6039 which does go beyond the scope of this article, but can be learned about at the link below:

NASPP | Understanding Compliance Under Section 6039

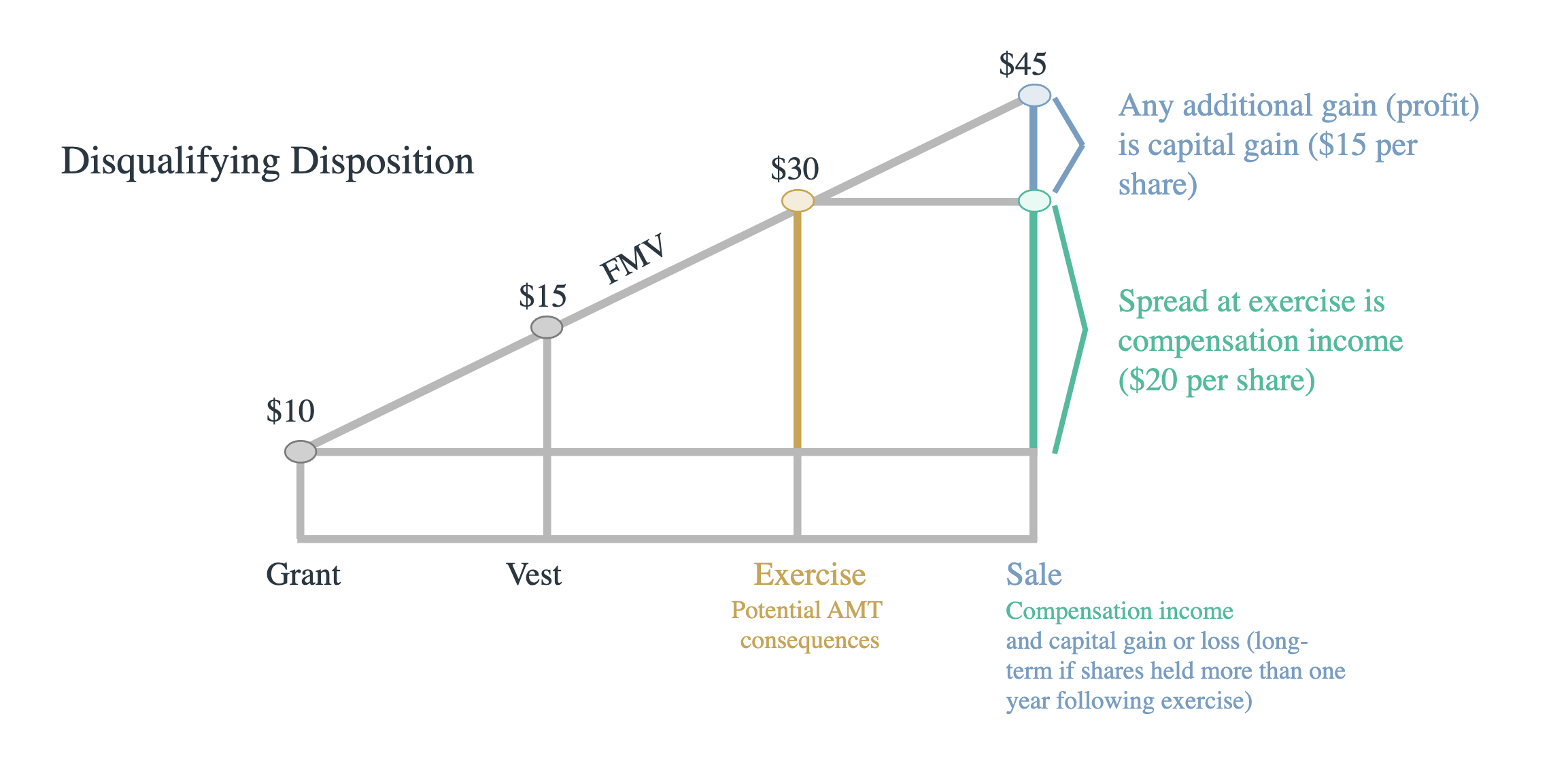

Disqualifying Disposition

To break it down rather simply, a disqualifying disposition is essentially one where either the one year from date of exercise and or two years from date of grant holding period, has not been satisfied.

Using the same example as before, let’s talk about what changes when a disqualifying disposition occurs.

- Grant Date: June 1st, 2021

- Exercise Price: $10

- Shares: 4000

- Date of Exercise: May 30th, 2022

- FMV at Exercise: $30

- Shares Exercised: 1000

- Date of Disposition: May 31st, 2023

- FMV at Sale: $45

- Shares Sold: 1000

This scenario is a disqualifying disposition solely because the award holder did not wait the additional day to satisfy the two years from date of grant requirement, despite holding the award for the required one year from date of exercise.

What does this mean for the award holder though? Well, it isn’t as simple as just being the reverse of a qualifying disposition, the award is now no longer one that qualifies for preferential tax treatment, which means that the award for all intents and purposes, will now be treated as an NQSO, which you can learn more about at the links below:

NASPP | Guide to Nonqualified Stock Options

NASPP | Stock Plan Fundamentals

This scenario means that the award is no longer being taxed on only the spread between the strike price and FMV at date of sale. Instead, the calculation will go as follows:

Compensation Income = $20,000

- $30 (FMV at date of exercise) - $10 (Strike Price) = $20 (Spread)

- Shares = 1000

- Tax Rate = Max of 37%

Long Term Capital Gains = $15,000

- $45 (FMV at date of sale) - $30 (FMV at date of exercise) = $15 (Spread)

- Shares = 1000

- Tax Rate = Max of 20%

As you can see the overall gain of $35,000 remains the same, however, the breakdown is now segmented into two parts: compensation income and long term capital gains, which the employee was lucky enough to qualify for, due to the holder retaining ownership of the shares for the required year needed for long term capital gains rates, which any capital asset can qualify for if held for a full year before disposition.

IRS | Topic no. 409, Capital gains and losses

Company Obligations: Reporting

“But what does this mean for the company and their reporting obligations?”

Well, because this was a disqualifying disposition there would be a compensatory element to the award which would need to be reported on the employees W-2.

This also means that because there was compensation income, the company would be entitled to a tax deduction equal to the compensatory element of the award, which in the above example, is $20,000. This tax deduction by the company is something that wouldn’t normally be possible if the disposition was a qualifying one.

A great tip to remember is that a company can only take a tax deduction if there is a compensatory element to the award, which in relation to ISOs will not be known until the actual sale of the award.

The reporting requirements under section 6039 are also still in effect, which does go beyond the scope of this article, but can be learned about at the link below:

NASPP | Understanding Compliance Under Section 6039

Ask the Equity Expert

The more you discuss equity compensation the more questions that tend to arise, for this reason we want to make sure that our readers are aware that we do have resources available for you to gain further clarification on your most pressing issues, and one such resource is our live Ask the Equity Expert sessions, where attendees can ask the one and only Barbara Baksa any of their most pressing questions in relation to equity comp.Follow us on LinkedIn to stay updated on upcoming sessions, which typically occur on the last Thursday of every month!

NASPP | LinkedIn

-

By Jason MannContent Director

NASPP