Disqualifying vs Qualifying: ESPPs

April 17, 2024

Tax qualified awards such as qualified section 423 ESPPs and ISOs, are those that offer the opportunity for employees to gain the most favorable possible outcome as it relates to the taxation of their awards. However, in order to obtain these benefits, there are rules that must be followed.

In this article we’ll be discussing at a high level, what a qualifying and disqualifying disposition is, as well as the tax implications of both types as it relates to employee stock purchase plans.

Preferential Tax Treatment

Before beginning, let’s first explain what “preferential tax treatment” is and why in 99% of situations, award holders of a tax qualified award would prefer to dispose of their shares in a qualifying disposition.Employee Stock Purchase Plans

Qualified section 423 ESPPs are programs that only employees can participate in and have quite a few requirements that must be understood from the company side to even qualify for preferential tax treatment under section 423.

Some of those requirements are as follows:

- Plan must state the maximum number of shares that can be issued

- Shareholder approval required within 12 months of board adoption of plan

- Only employees can participate

- 5% shareholders are not allowed to participate

- Substantially all employees must be allowed to participate

- All employees must have the same rights and privileges

- $25,000 limitation

- Purchase price cannot be less than the lower of 85% of FMV at grant or purchase

- Etc.

In this article we will be discussing only the impact of disqualifying and qualifying dispositions, but linked below are additional resources that can be used to thoroughly understand this form of equity compensation.

NASPP | Employee Stock Purchase Plans

NASPP | Guide to Education Employees About ESPP

NASPP | Stock Plan Fundamentals

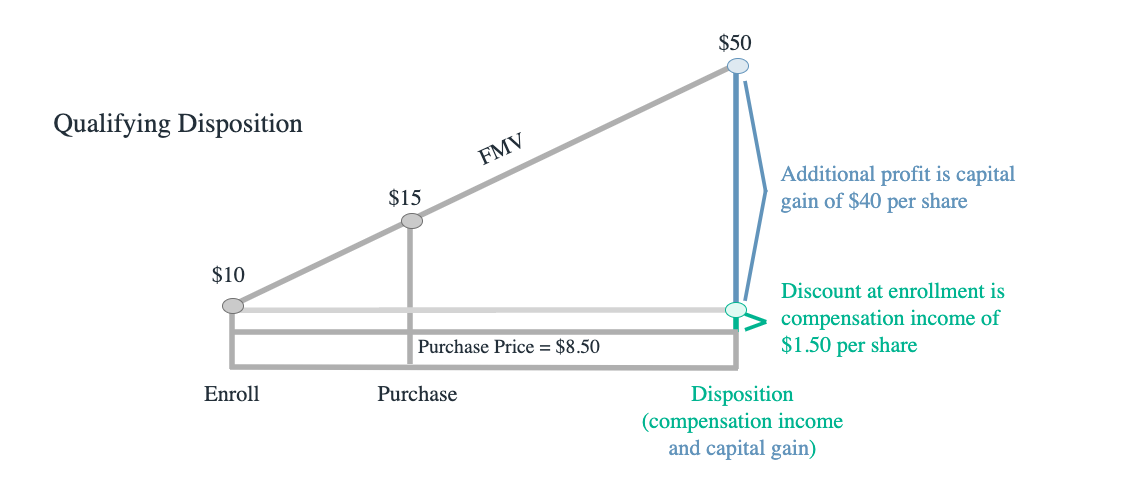

Qualifying Disposition

A qualifying disposition is one where the employee holds their shares for more than two years after the enrollment date and more than one year from the purchase date. If both requirements are met in relation to the disposition of shares acquired from a qualified section 423 ESPP, then the holder qualifies for what we call “preferential tax treatment”.

- Enrollment Date: June 1st, 2021

- Enrollment Date FMV: $10

- Look back: Yes

- Discount: 15%

- Purchase Date: December 1st, 2021

- Purchase Date FMV: $15

- Purchase Price: $8.50

- Shares Purchased: 1000

- Date of Disposition: June 2nd, 2023

- FMV at Sale: $50

- Shares Sold: 1000

Long Term Capital Gains = $40,000

- $50 (FMV on date of sale) - $10 (FMV on date of enrollment) = $40 (Spread)

- Shares = 1000

- Tax Rate = Max of 20%

Compensation Income = $1,500

- $10 (FMV on date of enrollment) - $8.50 (Purchase Price) = $1.5 (Spread)

- Shares = 1000

- Tax Rate = Max of 37%

Company Obligations: Reporting

“But what does this mean for the company and their reporting obligations?”

Well, because there was a compensatory element to the award and that being the spread between the enrollment date FMV and the actual purchase price, the company would have an obligation to report that amount on a Form W-2, but please note that because this was a qualifying disposition, the company would not be allowed to take a corporate tax deduction.

Lastly, the company would also have a reporting requirement under section 6039 which does go beyond the scope of this article, but can be learned about at the link below:

NASPP | Understanding Compliance Under Section 6039

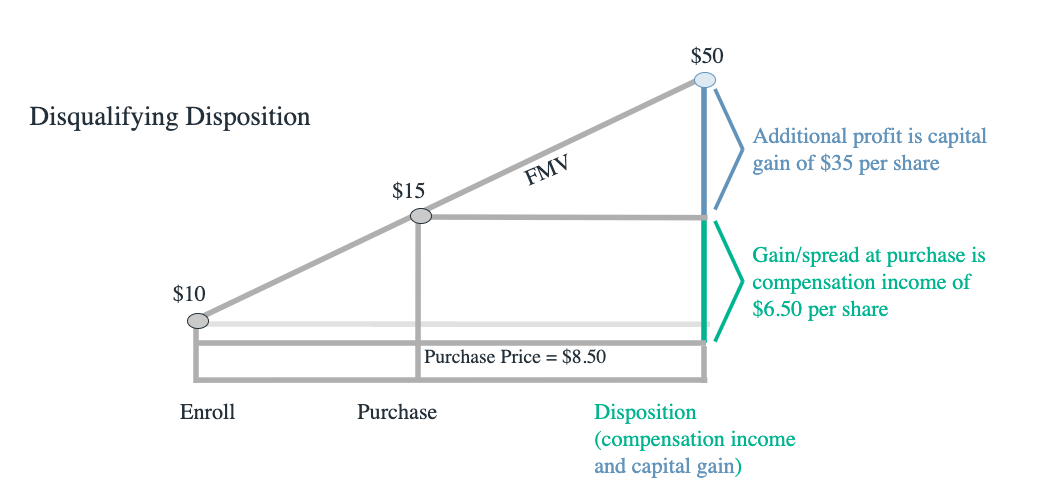

Disqualifying Disposition

To break it down rather simply, a disqualifying disposition is essentially one where either the more than one year from date of purchase and or two years from date of enrolment holding period had not been satisfied.

Using the same example as before, let’s talk about what changes when a disqualifying disposition occurs

- Enrollment Date: June 1st, 2021

- Enrollment Date FMV: $10

- Look back: Yes

- Discount: 15%

- Purchase Date: December 1st, 2021

- Purchase Date FMV: $15

- Purchase Price: $8.50

- Shares Purchased: 1000

- Date of Disposition: December 2nd, 2022

- FMV at Sale: $50

- Shares Sold: 1000

This scenario is a disqualifying disposition because the award holder did not wait the more than two years from date of enrollment requirement, despite holding the award for more than one year from the date of purchase before selling.

So, what does this mean for the award holder? Well, because this was a disqualifying disposition the employee is not going to have the most favorable possible outcome in relation to the taxation of their award.

Instead, the calculation will go as follows:

Long Term Capital Gains = $35,000

- $50 (FMV on date of sale) - $15 (FMV on date of purchase) = $35 (Spread)

- Shares = 1000

- Tax Rate = Max of 20%

Compensation Income = $6,500

- $15 (FMV on date of purchase) - $8.50 (Purchase Price) = $6.5 (Spread)

- Shares = 1000

- Tax Rate = Max of 37%

As you can see the overall gain on the award is still $41,500, but the breakdown in relation to how taxes are calculated is a bit different.

Because this was a disqualifying disposition, the compensatory element of the award is calculated based upon the actual purchase price and that of the FMV on date of purchase, which creates a larger spread than that of a qualifying disposition, which calculates the compensatory element of the award based upon the spread between the actual purchase price and that of the enrollment date FMV.

Company Obligations: Reporting

“But what does this mean for the company and their reporting obligations?”

Well, because this was a disqualifying disposition the company is allowed to take a corporate tax deduction that equals the compensatory element of the award and like a qualifying disposition, the compensatory element to the award would also need to be reported on the employees W-2.

The reporting requirements under section 6039 are also still in effect, which does go beyond the scope of this article, but can be learned about at the link below:

NASPP | Understanding Compliance Under Section 6039

Employee Stock Purchase Plan Essentials

ESPPs are a great way to reward employees, but for those unfamiliar with these programs it can be quite intimidating to implement and administer them. For that reason we have created our Employee Stock Purchase Plan Essentials course to help you build the foundation you need to confidently administer and implementate an employee stock purchase plan-

By Jason MannContent Director

NASPP