Accounting Complexities of Incentive Stock Options and the $100K Limit

October 09, 2025

Incentive stock options are an attractive form of employee compensation in the United States due to their favorable tax treatment. However, they come with certain limitations—most notably, the rule that the aggregate grant date fair market value of ISOs that become exercisable in any calendar year cannot exceed $100,000 per employee. If this threshold is exceeded, the portion of ISOs that surpasses the limit loses its preferential tax status and is treated as nonqualified stock options instead.

This situation can introduce complications in expense recognition, tax reporting, and may trigger special disclosure considerations.

Expense Calculations

In practice, when an award is split into ISO and NQSO portions due to the $100,000 limit (see Table 1 as an example), the total grant date fair value of both portions should be amortized as if they were a single combined award. After all, the employee was granted a single ISO award that was artificially divided for tax compliance purposes. These split awards are commonly presented as two separate grants issued on the same grant date, often with distinct vesting schedules based on when the $100K limit is reached. This approach helps clarify the tax treatment but can create additional administrative and accounting burdens.

Table 1: An ISO Award Split into ISO and NQSO Portions

Original Grant

| Grant Details | |

| Grant Date | 1/1/20X1 |

| Number of Shares | 12,000 |

| Fair Market Value | $10 |

| Final Vest Date | 12/31/20X1 |

| Total Grant Date FMV | $120,000 |

| Value in excess of $100K | $20,000 |

Split Grant

| ISO Portion | NQSO Portion | |

|---|---|---|

| Grant Date | 1/1/20X1 | 1/1/20X1 |

| Number of Shares | 10,000 | 2,000 |

| Fair Market Value | $10 | $10 |

| Final Vest Date | 12/31/20X1 | 12/31/20X1 |

| Total Grant Date FMV | $100,000 | $20,000 |

Be cautious when using standard expense reports from off-the-shelf financial reporting software tools. These solutions may assume that both portions of the awards will start expensing from the grant date to their respective vest dates. This would result in frontloading expense, with more being recognized earlier in the vesting life, rather than straightlining expense for the combined award over its full life.

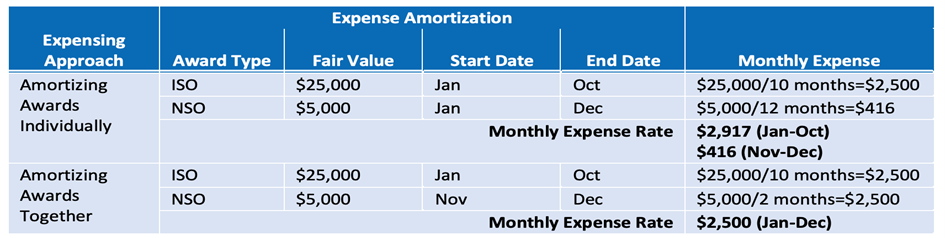

Now, assume that the total grant date fair value of the above example award in Table 1 using the BSM formula is $30,000 (not to be confused with the grant date fair market value, which is based on the stock price at grant). The expensing methodology will result in different monthly expense amounts, as shown in Table 2.

Table 2: Monthly Expense Amortization under Different Expensing Approaches

In some financial reporting systems, companies may be able to fix the expense pattern problem by overriding the service inception date (also known as the expense start date) for the NQSO portion. However, it can be a burdensome, manual process given that awards can be split in various ways. Let’s look at a more complex award example in Table 3.

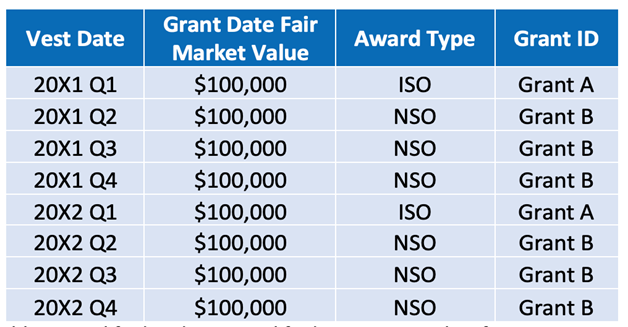

Table 3: Qualified and Non-Qualified Vesting Tranches for an ISO Award

This first tranche of the award is qualified for the preferential tax treatment, while the remaining tranches vesting in the current year become non-qualified. Then, the following year, the $100,000 limit resets for another tranche, and the remaining tranches are again classified as NQSOs.

In this case, we need to analyze the expensing start and end dates for each vesting tranche to preserve the straight-line expense. For instance, the 20X2 Q1 tranche should not start expensing when the previous tranche of the award (i.e., the Q1 20X1 tranche) vests. Instead, the expense should commence when the Q4 20X1 tranche vests.

The process gets even more complicated when companies grant awards that vest monthly over four years, and there are 48 tranches to review for each award. This is in addition to the possibility that employees may have multiple awards granted over time. Therefore, automation is critical to reduce manual errors when modifying the service inception date for awards with multiple tranches.

Tax Reporting Complexities

Although the ISO and NQSO components of the award are valued and amortized as a single award, they should be tracked separately due to the different tax treatments. For an employee to receive the tax advantages of an ISO, its sale must be made at least two years after the grant date and one year after exercise. If the shares are sold before the holding period requirements are met, then a disqualifying disposition event occurs.

Companies cannot realize a tax benefit on ISO exercises as long as the holding requirements are met. Therefore, companies generally don’t set up a deferred tax asset (DTA) balance for the ISO component.

However, when a disqualifying disposition event for the ISO component occurs, the employee recognizes ordinary income, and the company realizes a tax benefit similar to that on a normal NQSO.

Generally, the amount of income and tax benefit realized is based on the difference between the exercise date stock price and the strike price at the time of exercise. However, if the shares are sold at a price less than the exercise date stock price, then the tax benefit is limited to the difference between the strike price and the sale date stock price.

Disclosure Requirements

ISOs can create several considerations for footnote disclosures. First, consistent with the expense calculation, the remaining expensing life of awards should reflect the combined ISO and NQSO components. Many financial reporting systems cannot calculate expense life based on the combined award, creating the need for manual calculations.

In addition, the disclosed fair value and the underlying BSM assumptions should reflect the single set of shares issued with the same expected term and other attributes.

Finally, it’s generally better to disclose ISOs and NQSOs together, since their valuation and expense amortization are performed together.

Accurate ISO Accounting and Compliance

When relying on off-the-shelf financial reporting software, it’s critical to understand what overrides or manual adjustments may be needed to ensure proper reporting methodologies are applied. Where possible, seek solutions that offer automation to streamline the accounting for ISO awards and reduce the risk of errors or inconsistencies.

Learn More

Check out the NASPP blog: How to Handle ISO Valuation and the $100K Limit to explore valuation considerations for ISOs and gain a deeper understanding of the ISO $100K limit.

-

By Boxian KolbManaging Director

Equity Methods

-

By Amanda TanCorporate Financial Reporting Manager

Equity Methods