A Guide to 409A Valuations for Startups

April 10, 2024

Introduction

Simply put, a valuation carried out by an independent third-party valuation team to define the strike price of the employee stock option is known as 409A Valuation.

A 409A valuation sets the strike price for common shares typically awarded to employees as part of ESOP(employee benefit plan). While businesses often undergo various valuations, the 409A valuation is specifically for establishing safe harbor status with the IRS.

The IRS regulates this process to ensure that the FMV of the stock options is priced reasonably. Private companies need a 409a valuation to offer equity, and if they are not compliant, they could face hefty penalties.

So, getting a 409A valuation and refreshing it yearly is a mandatory process any business should undergo. Let’s discuss the 409A valuation process and its benefits.

What is a 409A Valuation?

409A valuation is derived from section 409A of the US tax code. 409A valuation for startups is essential for any private company looking to offer equity to employees or other service providers. It's an independent appraisal that helps determine the fair market value (FMV) of the company's common stock—usually reserved for founders and employees. Unlike public companies, whose stock value is determined by market trades, private companies need a 409A valuation process to set this value.

What is its purpose?

This valuation not only helps establish the FMV but also sets the "strike price"—the price at which employees can buy the stock. It needs to be at or above the FMV to avoid IRS violations. Startups typically invest in these valuations to ensure they offer equity at a fair, IRS-compliant price.

Getting a 409A valuation for startups is a regulatory step. Not aligning these values can lead to the risk of noncompliance with 409a valuation for startups and heavy penalties from the IRS. So, if you're considering providing equity, this valuation is your first step toward a clear and compliant equity plan.

Why Startups Need 409A Valuations?

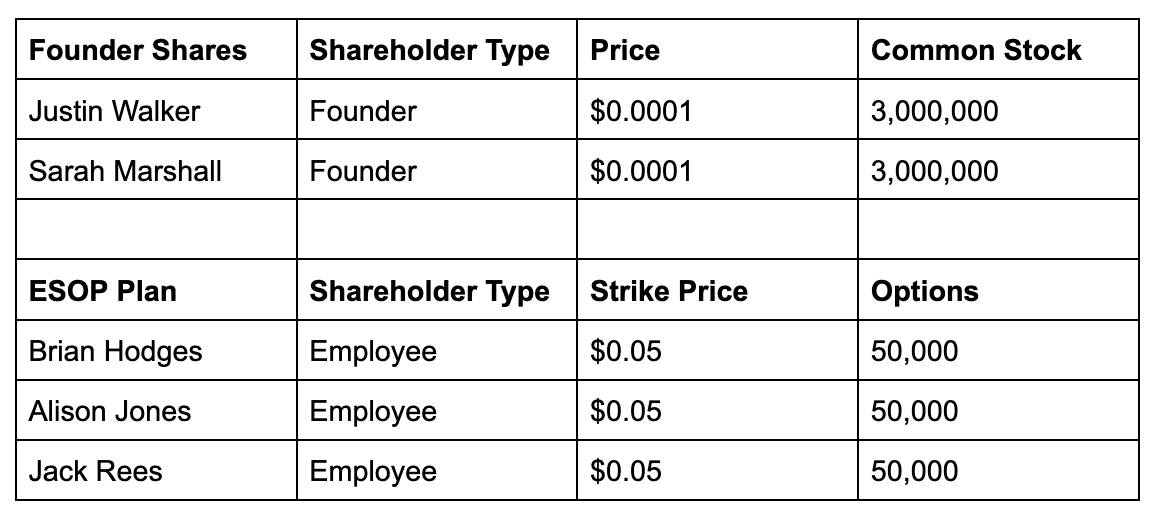

Startups primarily need 409A valuation processes for their stock plans. Employee stock plans offer employees equity shares as a form of ownership in the company.

So for example, if the latest 409A valuation set the FMV at $0.05, then new incoming employees would have a strike price of $0.05 for their stock options.

In a nutshell, it's required to have a 409A valuation to set and defend your strike price used.

Employee stock plans also offer substantial tax benefits to both the company and the employees buying them (see details for ISOs). So, employers frequently use them to align employee and stakeholder goals. The employees can purchase these options at a fixed price called the “strike price” per share.

Section 409A provides private companies with guidelines regarding the appropriate valuation of their shares. And this 409A valuation for startups is important for two reasons:

Legal compliance:

With a 409A valuation for startups, you ensure that your business follows all tax regulations and prevent IRS audits that may lead to legal, tax, and operational complications. In the event of incorrect pricing, your employees may be subject to immediate taxation (20% federal penalty). It's critical to remember that you granted your staff stock options as a reward and not to subject them to a hefty IRS penalty.

Equity compensation:

For a company to succeed, it must be able to do three things:

Retain existing employees,

Recruit top talent and

Encourage them to do their best work.

And employee stock plans serve all these purposes well (There’s a reason VCs/investors require companies to set up and implement a stock plan to incentivize staff. They need growth and fast).

In this case, an accurate 409A valuation for startups is crucial to providing employees with fair equity compensation. It calculates the fair market value (FMV) of the company's shares to prevent the stock option from being incorrectly priced and make it an alluring and reasonably priced offer for employees.

When Should Startups Get a 409A Valuation?

A company must obtain a 409A valuation at certain intervals to ensure regulatory compliance and effective equity compensation management. It is especially crucial at the following stages.

Issuing stock options: Before issuing stock options or granting equity to workers, a 409A valuation for startups determining the stock's fair market value (FMV) should be in place. Doing so would save the business and its employees’ money in the long run by avoiding potential tax issues caused by incorrectly priced stock options.

Trigger events: When a startup experiences a "trigger event" that might significantly impact its 409A valuation process, the firm must revise its value projections. For instance, significant investment rounds, or changes to the company model and financial predictions may have occurred. These things can make a big difference in the company's worth, so revaluation to keep the stock price is still correct.

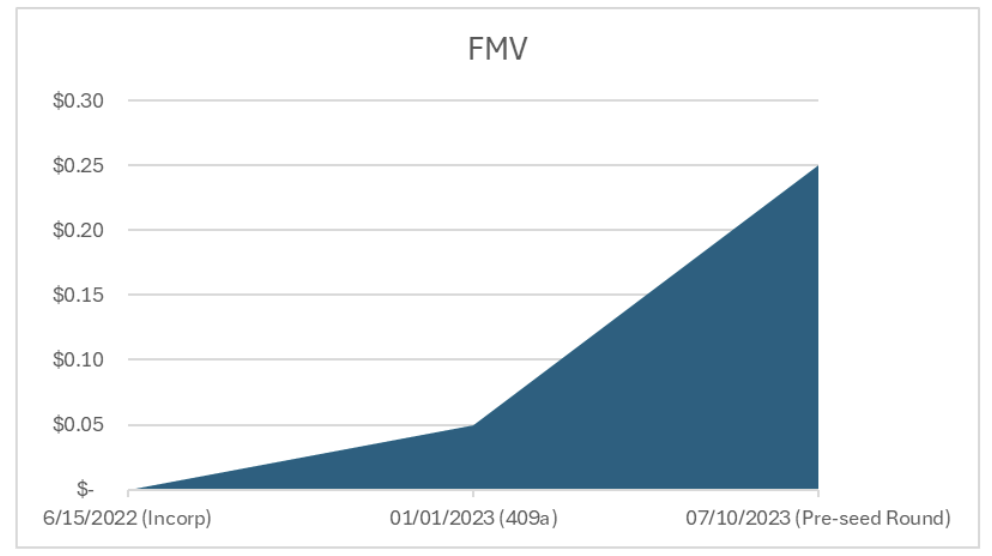

For example, if a Company had a 409A valuation done on January 1st, 2023 at $0.05, but then underwent a pre-seed round at a $8 million pre-money valuation in July 2023, and the FMV increased from $0.05 to $0.25, they would need to get an updated 409A valuation.

As the last 409A valuation in Jan 2023 would be invalid due to the new funding round, they would need to update this for their new incoming staff.

Factors Influencing 409A Valuations

Factors influencing 409A valuation processes can vary significantly depending on the stage of the Company. One bucket doesn’t fit all. But if you have to group companies into three buckets, it would most likely be: Pre-revenue, recently funded companies, and companies in the middle.

Asset-based approach for pre-revenue companies: An asset-based strategy is often appropriate for pre-revenue enterprises or start-ups. Basically, the strategy determines the company's worth by evaluating its tangible and intangible assets.

This method ignores the possibility of future profits while maintaining the status quo on what is very important for valuing startups now—even if these startups have not yet generated consistent cash flow.

Recently Funded Companies: When determining the startup's valuation, it is important to consider the terms and scope of previous funding. For 409A valuation processes based on the market method, recent fundraising rounds could provide insight into the company's worth. There is also the absolute and relative valuation, which compares the startup to others in the same field and uses the measurements of those companies to figure out how much the startup is worth.

Other companies in the middle: For companies in the middle, past the early stages with some consistent revenue, but before or in between funding rounds, normally a market approach is used. This method takes a sales or EBITDA multiple on past figures to determine the FMV.

The 409A Valuation Process

Now that you know what determines a 409a valuation process result and when you must consider one, it’s time to understand what are the first steps, including gathering the Company documents.

Data Gathering and analysis

The 409A valuation process commences with gathering vital data, including

Historical financial statements,

Market data, and

Business forecasts.

Such data can comprise information regarding the company's business plans, industry analysis, and capitalization tables. So, if you want an accurate valuation, you must provide a full view of the company's financial health and prospects.

Valuation Methods

There are a few commonly used approaches to perform a 409A valuation for startups:

Market Approach: Using this method, you can compare the company to similar publicly traded companies and use valuation multiples like revenue or EBITDA to estimate the company's value.

Income Approach: You can consider this method if your business has stable and predictable cash flows. This method uses a discounted cash flow (DCF) model to forecast and discount future earnings to their present value.

Asset Approach: If your company is early-stage or asset heavy, this method calculates its value based on the sum of its assets minus liabilities.

Backsolve Method: The Backsolve Valuation Method is generally the best choice for companies with a complicated capital structure that includes different types of equity, such as convertibles, warrants, options, profits, or interests, whether common or preferred. Used mainly for funded companies.

Insider Tips for 409A Valuation: Maximizing Accuracy and Compliance

How can you ensure your valuation is accurate and audit defensible?Here are a few tips:

Understand the Purpose of 409A Valuations: It's important to understand that 409A valuations for startups are used for a specific purpose for stock plans. They help you set reasonable stock option pricing while minimizing your tax liability. These values aim to comply with IRS laws that try to close tax deferral loopholes by granting stock options at or above market value.

Engage Expert Valuation Specialists: Finding a valuation firm that specializes in 409A valuations is a smart move. These experts are familiar with the necessary procedures and regulatory requirements, so you can be certain that your valuation is up-to-date and fair. They can also inform you of other important rules & filing for tax advantages, like 83b filing.

Plan Valuation and issuance Timing Strategically: Also, the timing of a 409A estimate can have a big effect on how relevant and correct it is. So, it's best to do it around the time of fundraising, big financial changes, or company strategy modifications. For example, a well-planned strategy for 409a valuation for startups would allow you to issue stock at low price before a huge share price increase

Document and Retain Valuation Records: Documenting and keeping all valuation documents and data ensures valuation integrity and prepares the organization for future audits. These records should include detailed notes on the following:

The methodologies used

Assumptions made

The rationale behind selecting specific valuation models

Being proactive in these areas can help mitigate risks associated with non-compliance, including penalties and taxes imposed on both the company and its employees.

Look for Expert 409A Valuation Reports!

As startups grow, they must understand how 409A valuation processes can affect their financial and operational strategies. Clarity on the objective helps obtain an accurate valuation, whether for issuing stock options, raising funding, or any other purpose.

--

Colin McCrea, CVA, is head of the valuation team at Eqvista. He has years of experience in the taxation and auditing sector for small and medium sized companies in the U.S. and Asia. He is currently managing company valuations and corporate taxation at Eqvista.

-

By Colin McCreaHead of Valuations

Eqvista