Section 16 Reporting After Insider Departure

February 11, 2026

When a Section 16 officer or director leaves your company, it’s easy to assume their reporting obligations end that same day. In many cases, they do. But not always.

Section 16 reporting after termination can continue in limited circumstances, particularly when insiders engaged in nonexempt transactions during the six months prior to their departure. For stock plan administrators and legal teams overseeing insider reporting obligations, understanding these nuances is critical to avoiding short-swing profit exposure, delinquent filings, and proxy disclosure issues.

Here’s what you need to know when managing Section 16 compliance after an insider departure.

Exempt Transactions After Termination Are Not Reportable

First, the good news: transactions that are exempt from the short-swing profit recovery provisions under Section 16(b) and that occur after the individual ceases to be an insider are generally not reportable.

This includes many routine equity plan transactions, such as:

- Option exercises (although a same-day sale may be treated differently)

- RSU vesting

- Share withholding to cover taxes

- Forfeitures of awards with no consideration

- Gifts of stock

Because most officer and director equity activity falls into these categories, many former insiders will not have any ongoing post-termination Section 16 reporting obligations.

Check out our “Quick Guide to Post-Insider Transactions.”

Nonexempt Transactions May Still Trigger Reporting

Where companies run into trouble is with nonexempt transactions.

Open market purchases and sales are typically nonexempt. If a former insider engages in a nonexempt transaction within six months of an opposite-way nonexempt transaction that occurred while they were still subject to Section 16, the later transaction remains reportable—even after departure.

If the trade also produces a profit, it may trigger short-swing profit recovery under Section 16(b).

This is why a six-month lookback review should be part of every Section 16 compliance checklist when an officer or director leaves. Without that review, companies can easily miss a lingering reporting obligation.

The NASPP article “Section 16 Obligations After Insider Status Ends” explains how to determine which nonexempt transactions must be reported after an insider’s exit and includes several reporting examples.

Pre-Termination Transactions Must Still Be Reported

Ending insider status does not eliminate reporting responsibility for transactions that occurred prior to the insider’s departure.

Any reportable transactions that took place while the individual was still subject to Section 16 must be disclosed. If these transactions haven’t yet been reported at the time of the insider’s exit, they must be reported afterwards.

This often includes:

- Small acquisitions eligible for Form 5 reporting

- Other Form 5-reportable transactions

- Delinquent Form 4 filings that were overlooked

Best practice is to address these items at the time of departure rather than waiting until year-end. It is much easier to resolve open items immediately than to track down a former executive months later.

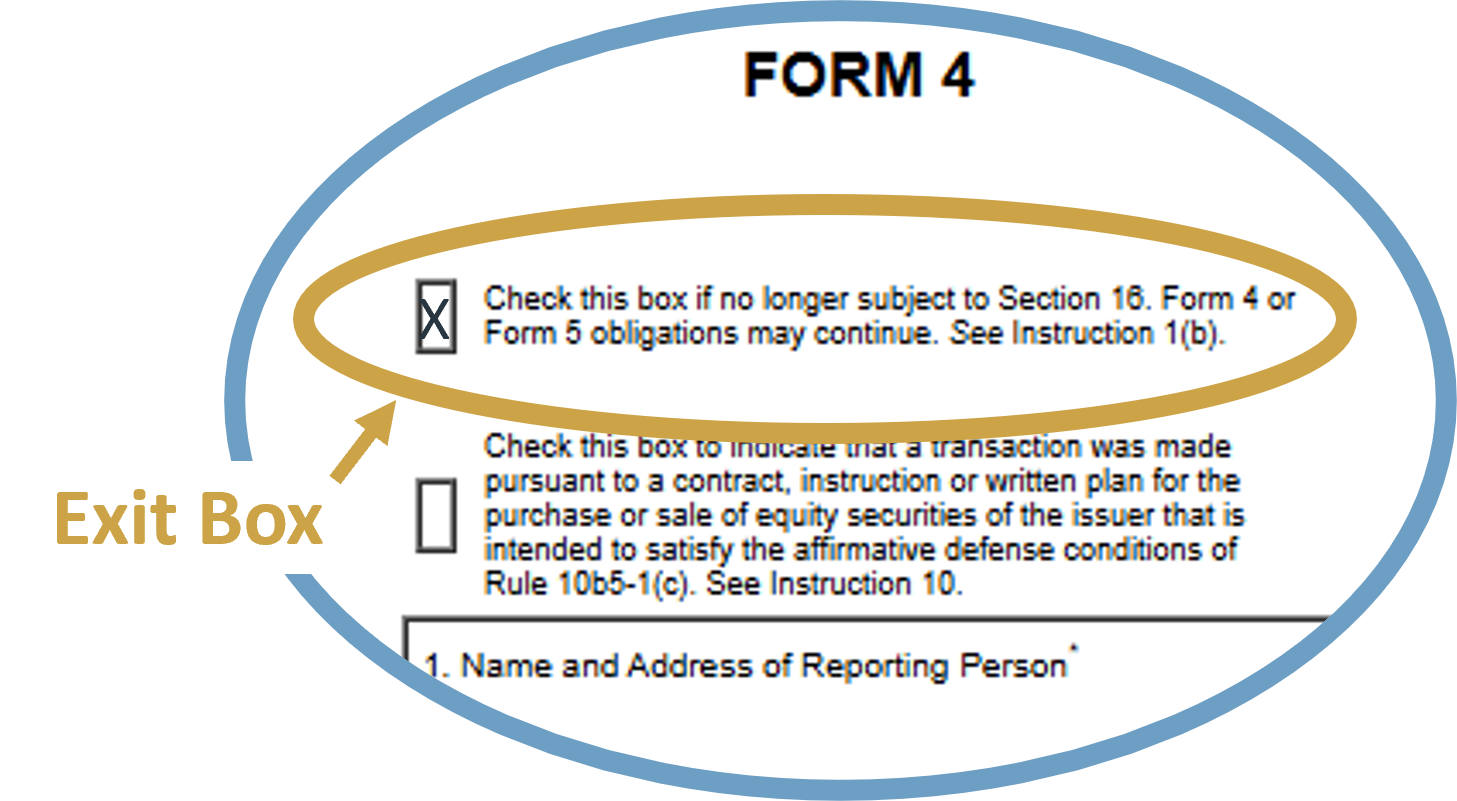

Remember to Check the “Exit Box”

If you file a Form 4 or Form 5 after the individual is no longer subject to Section 16, you must check the box indicating this status.

he “exit box” appears just below the form heading and signals that, although insider status has ended, reporting obligations may continue.

It is a small detail—but one that should be part of your standard filing procedure for post-termination Section 16 reporting.

No Filing Is Required to Announce Termination

Companies sometimes ask whether they must notify the SEC that an insider has left.

There is no requirement to file a Form 4 or Form 5 solely to report cessation of insider status.

Some individuals choose to voluntarily file a blank Form 4 with the exit box checked, but this is optional—not required.

Don’t Overlook Rule 144 Obligations

Section 16 status and affiliate status under Rule 144 are determined differently.

A former officer or director may still be considered an affiliate based on facts and circumstances. In addition, Rule 144(b)(2) provides that former affiliates remain subject to Rule 144 for 90 days after ceasing affiliate status.

As a result, even if Section 16 reporting has ended, Form 144 filing requirements may continue.

For stock plan professionals, this distinction is especially important when supporting executive sales after termination.

Plan for EDGAR Account Transition

Administrative cleanup is just as important as transaction analysis.

If your company files Section 16 reports on behalf of insiders, you will need a process for transitioning EDGAR account access when someone departs.

Depending on your role, this may include:

- Transferring account administrator responsibilities

- Removing delegated entities, administrators, and users once no further filings are expected

Leaving EDGAR access unmanaged could result in a failure to complete the annual confirmation of the account, which could lead to inactivation of the account. If the former insider still needs to submit Section 16 filings, they would have to submit a new Form ID to reactivate the account—no one wants that!

Failing to remove entities and individuals who no longer need access to the account creates a risk of inadvertent filings.

Educate Departing Insiders About Ongoing Obligations

Even if your company continues to handles their filings, former insiders should understand whether they have any continuing reporting exposure.

If a nonexempt transaction occurred within six months prior to departure, the insider should be notified that opposite-way trades during the remaining window may still be reportable.

A brief written summary provided during the exit process can prevent misunderstandings and protect both the individual and the company.

Keep Former Insiders on Your Year-End Checklist

Former insiders should remain on your Section 16 year-end checklist for the fiscal year in which they departed. There may still be:

- Form 5 filings

- Delinquent transaction disclosures

- Item 405 proxy disclosures

Removing them from your tracking process too soon is a common source of compliance gaps.

A Practical Section 16 Compliance Checklist for Departures

When an officer or director leaves, consider building these steps into your standard process:

- Conduct a six-month review for nonexempt transactions

- Confirm all pre-termination transactions have been reported

- Address any Form 5-reportable or delinquent transactions

- Use the Form 4/5 exit box when applicable

- Review potential Rule 144 affiliate status

- Transition EDGAR account administration

- Provide written guidance to the departing insider

- Retain the former insider on your year-end review checklist for the current year

With a defined process in place, Section 16 reporting after insider departure becomes manageable—and predictable—rather than reactive.

Key Resources

- Article: Section 16 Obligations After Insider Status Ends

- Quick Guide: Post-Insider Transactions

- For the latest Section 16 developments, check out our webcast "2026 Section 16 Developments with Alan Dye."

-

By Barbara BaksaExecutive Director

NASPP